About this report

This report was researched and written in the Spring of 2018. It is predominantly based on publicly available information and reflects the views and understanding of the authors, in what is a complex and evolving landscape of fiscal devolution and financial freedoms available to combined authorities. As such, while we believe that this report provides a comprehensive overview of the state of play in Spring 2018, the situation may have evolved further since it was written. The document is also not intended to provide a detailed legal basis for decision-making in combined authorities. The content that follows is for informative purposes only.

Overview

A significant body of existing evidence points to the fact that, compared to its international peers, the UK has a particularly centralised system of government finance. However, whilst still largely centralised, the last decade has seen some progress towards reforming and improving the extent and nature of financial freedoms available to local areas. The introduction of devolution deals agreed since 2010, the development of mayoral and non-mayoral combined authorities and the potentially significant changes still to come in local government finance (including business rate retention, the outcome of the fair funding review and devolution of the adult education budget), are prime examples of these moves.

In the context of these changes, this report focuses on changes that have affected mayoral and non- mayoral combined authorities in England. It assesses the extent and nature of financial freedoms that have been provided to combined authorities and whether and how these have been used in practice. Overall it finds that, while the Government has attempted to open up financial freedoms to local decision makers, in practice the scale of progress has so far been relatively limited. The cause of this has been a range of philosophical and practical barriers that have limited the scope of the reforms to date. The last section of the report outlines a series of long and short-term options for how more progress could be made to ensure that local areas and, in particular, combined authorities can be given the freedom to tailor services, investment and project delivery to meet the needs of the people that live in these areas. Taking forward proposals in the direction suggested would ensure that the stated ambitions and aims of Governments since 2010 can be meaningfully achieved.

Introduction and context

Scope of project

This project was commissioned by the Local Government Association (LGA) on behalf of the Combined Authority Chief Executives Network.

It assesses the fiscal freedoms currently available to English CAs. At the time of writing there were nine CAs in England. Of these seven were mayoral CAs (* below):

- Cambridgeshire and Peterborough Combined Authority*

- Greater Manchester Combined Authority*

- Liverpool City Region Combined Authority*

- North East Combined Authority

- Sheffield City Region Combined Authority*

- Tees Valley Combined Authority*

- West Midlands Combined Authority*

- West of England Combined Authority*

- West Yorkshire Combined Authority.

The report is split into two broad sections. Sections one to five provide:

- a conceptual framework for understanding the nature and use of fiscal freedoms

- an assessment of the range of fiscal freedoms available to CAs, with reference to the differences in freedoms available to CAs

- an overview of the extent to which these freedoms are currently being used in each of the CAs

- An analysis of the real and perceived barriers that CAs have faced when looking to use fiscal freedoms.

Sections six and seven extend this analysis to comment on recent proposals for the extension of available fiscal freedoms; and make recommendations for areas where the range and use of fiscal freedoms could be improved or expanded over the short term.

Approach of project

The report is written based on evidence gathered between February and May 2018. It is based on two strands of work:

- an in-depth review of the existing literature, including, but not limited to, grey literature surrounding fiscal devolution and recent Government policy in this area

- in-depth semi-structured interviews with combined authority (CA) finance directors, civil servants and experts on fiscal devolution. These followed an initial presentation and discussion at the Combined Authority Finance Network convened by the LGA.

Overall, the project team has undertaken 15 semi-structured interviews across England. To allow participants to speak freely, these were conducted on a confidential basis. As such, this report relies mainly on publicly available information. Where sections of the report cover feedback from participants of the interviews, it does not attribute comments or themes to either individuals or the organisations of which they are part. Where specific references to individual CAs are made, these are based on publicly available information and the author’s own inferences based on this information.

Purpose of project

The purpose of this report is to provide officers and elected officials within combined authorities (CAs) (as well as those areas with potential to become CAs in the future) insight into the range of powers available and the potential lessons that can be learnt from experiences to date.

As such, it is aimed at an informed audience and does not provide an overview of the parliamentary and national and local political processes through which CAs have been created. Nor does it provide an in-depth assessment of the on-going discussion of the likely long-term future for devolution of decision making and finances in England. Information on these issues can be found on the LGA website and from various commissions on fiscal devolution.

However, it is important to note that this background information has an important bearing on this report. In particular, this report will show that the conceptual and practical scope of powers available to each of these areas differ significantly and that a main driver of this is the relative maturity of each of the CAs.

It is immediately clear that the majority of CAs have only recently been established. For example, Sheffield City Region was formally established by a statutory instrument in April 2014 and recently elected its first Mayor in May 2018. A number have grown out of and superseded previous Transport Authorities (for example, Liverpool City Region Combined Authority), and while this provides some experience and history of fiscal freedoms, on the whole, the use of fiscal freedoms across the majority of CAs is at a relatively early stage of development.

The obvious exception is Greater Manchester Combined Authority. This was formally established in April 2011, appointed an interim Mayor in 2015 and held its first election for a Mayor in 2017. It also has a history of developing relationships and undertaking collaborative work locally that has spanned the last 30 years. Here, the use of fiscal freedoms has been established and tested in practice over many years, meaning that the approach is far more developed.

To ensure that each CA finds this report useful, it draws out both lessons for those CAs or aspiring devolution areas that are looking to take on existing fiscal freedoms, as well as insights for more mature CAs that are looking to further extend their fiscal freedoms.

Scope of financial freedoms considered in this project

In reviewing the range of fiscal freedoms currently available to CAs, this project has considered financial freedoms that have been established through specific legislation and/or with specific agreement from central government. It has also considered financial freedoms that have previously been committed to through announcements from central government, including where the legislation to introduce the freedoms has fallen. This means that it does not consider in detail:

- potential future freedoms where there is not currently a legislative basis, or plan to introduce one, for the CA to take forward the freedom (eg a new local tax that is not currently legislated for)

- a range of freedoms viewed to be “business as usual”, where the general power of competence would allow CAs to act. For example, this includes attempts to leverage and/or attract private sector investment into the CA and the disposal of assets.

Understanding financial freedoms

What is meant by a financial freedom?

The first thing to clarify is what a financial freedom actually represents. One Combined Authority Finance Director interviewed as part of this project, summarised a financial freedom as follows:

…the ability to manage a single pot of funding with maximum flexibility on a multi- year basis, without intervention from Government

Combined Authority Finance Director

While many of the participants in our interviews echoed the quote above, it is also clear from the literature, wider discussions and assessments of announcements, policy statements and publications from central government, that there is not a single definition of what “financial freedom” means.

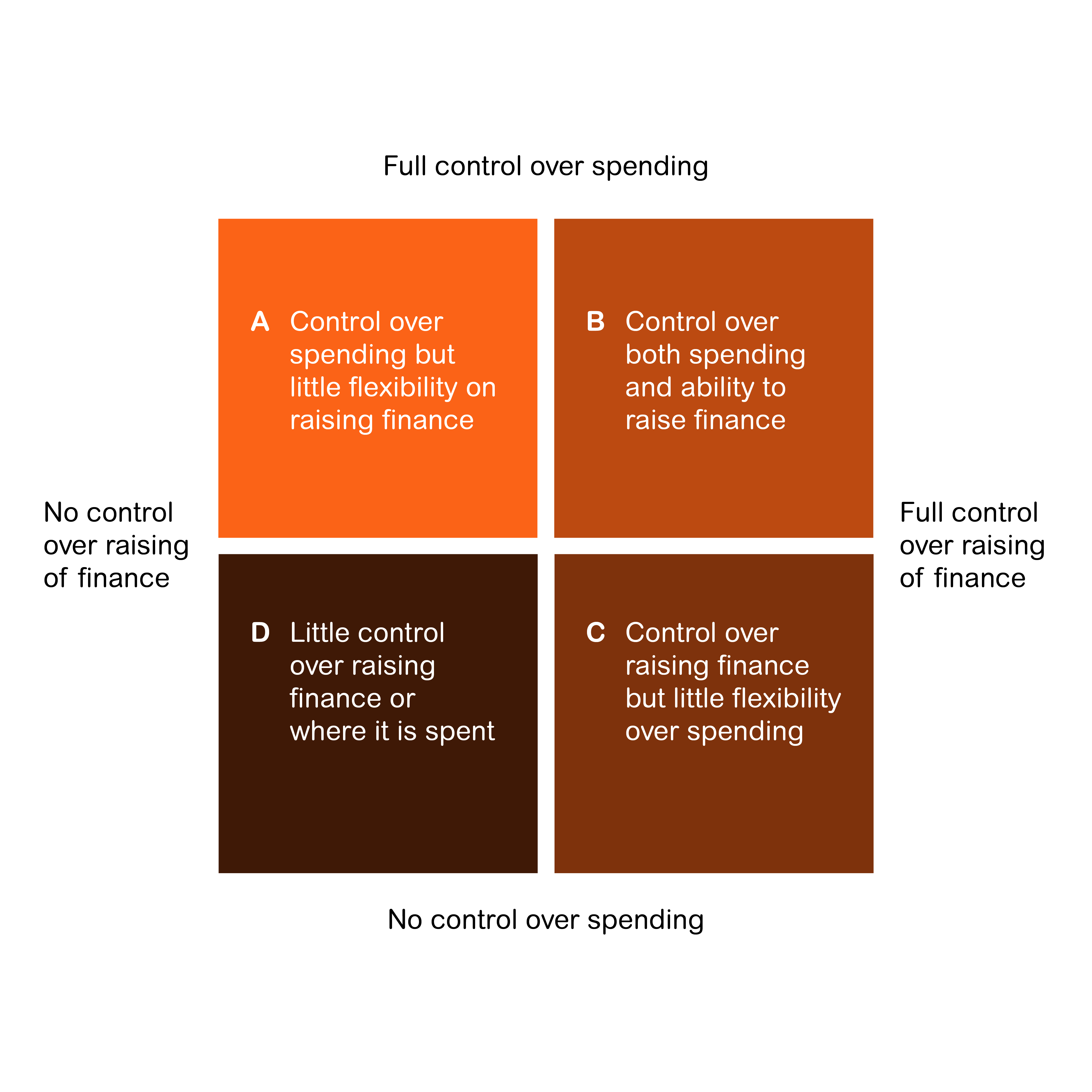

For the sake of clarity, this report considers financial freedoms across two key domains:

- Raising freedom: the extent to which CAs have control over the size of their budget and how it is raised. For example, a low range of freedom would be a grant from central government based on the number of people in the area, as the CA has no control over this. Conversely, a high range of freedom would be a locally-levied tax, where the CA can choose the rate and incidence of the tax and overall revenue raised

- Spending freedom: the extent to which CAs have control over how and where this budget is spent. For example, for a given budget, a low range of freedom would be that central government requires the money to be spent on a particular service (eg Police and Crime Commissioner functions). Conversely, a high range of freedom would be the CA having the flexibility to spend the money on priorities decided locally and at a time to suit local needs.

These distinctions are important. In committing to devolution, central government has acknowledged the importance of local decision making in ensuring that services are delivered effectively and efficiently and in a way that maximises impact by meeting local needs. In practical terms, this is only possible where there is a degree of freedom over both the raising and spending domain; where there are constraints over either of these domains, local decision making is limited, and the likelihood of local needs being met is reduced.

For example, if CAs have full spending freedom (they can spend a given budget where and when they like), but no raising freedom, in practice their spending decisions are limited by central government decisions of the size of budget allocated and the timescale over which it is given. There is also a lack of certainty about future budgets, as the decisions of central government can change relatively quickly. This can impact significantly on investment decisions and project viability.

Equally, where a CA has full raising freedom (they can choose to raise the money however they like), but no spending freedom, there is relatively little point in having the raising freedom; with money committed to specific services, this is only a choice of who bears the burden of taxation, rather than an ability to tailor local services to meet local priorities.

Figure 1 outlines that this can be conceptualised across two axes, leaving a four-quadrant classification of the scale of potential freedoms.

| Quadrant of freedom |

Summary |

Example |

| Control over both spending and ability to raise finance |

Greatest degree of flexibility and align with the definition at the beginning of Section 2. |

An extreme example of this would be complete fiscal devolution, where each CA set its own budget and raised its own finance, with no intervention from central government. The Mayoral Precept is the most obvious example of a current freedom located in this quadrant (though still located towards the bottom left of the quadrant as the overall size of the precept could potentially be limited by central government and scope of spending allowed is tied to devolution deals). |

| Control over spending but little flexibility on raising finance |

Moderate degree of flexibility – with more on the spending side. |

An example in this quadrant would be Gain Share / Investment Fund Grant. |

| Control over raising finance but little flexibility over spending | Moderate degree of flexibility – with more flexibility over raising finance. | An example in this quadrant would be the ability to raise a precept on council tax or vary business rates, but with a requirement that the revenue raised is spent on a particular transport scheme. |

| Little control over raising finance or where it is spent | Limited degree of flexibility over either revenue raising or spending. | An example is the Housing and Infrastructure Fund which is a competitive capital grant provided to councils and CAs to acquire land, deliver physical infrastructure and invest in housing. |

Overview of available financial freedoms

This section provides an overview of the range of potential financial freedoms available to combined authorities (CAs). It outlines:

- a description of the freedom and an overview of which CAs have access to this freedom

- the legislative route to the freedom having been made available, or to being made available in future

- whether there are variations in the scope or nature of the freedom available to each CA.

It then assesses the extent of freedom actually provided on each of the spending and raising domains. It uses the illustrative figure from Section 2 to summarise the findings.

For ease of reference, the tables below have classified freedoms on both the spending and raising domains on a three-point scale: low, moderate and high. This is summarised and described below. It is a subjective assessment based on our understanding of the freedoms available and our discussions with finance directors and wider stakeholders on how they are used in practice.

Low:

- Raising freedom: No flexibility at all, or flexibility limited to negotiation with central government. For example, grant funding would be low.

- Spending freedom: Tight constraints placed on how the money is spent. For example, a requirement to spend budget on “Fire and Rescue services” would be low.

Moderate:

- Raising freedom: Freedom provided within boundaries set by central government (eg a cap on the amount raised or specification of the rates within which a tax should fall).

- Spending freedom: Constraints are placed on how the money is spent – but these cover a wide range of options. For example, “transport” would be moderate as this covers a range of functions, whereas a Strategic Infrastructure levy would be low as it has to be spent on a specific project.

High:

- Raising freedom: Autonomy over the amount raised, how it is raised and when it is raised. For example, a general power to raise debt would by high.

- Spending freedom: Complete autonomy to spend how, where and when was needed to meet local needs.

Classifications Key for table below:

A) Control over spending but little flexibility on raising finance

B) Control over both spending and ability to raise finance

C) Control over raising finance but little flexibility

D) Little control over raising finance or where it is spent

| Instrument | Currently feasible | Legislative route | Commentary | Variation in powers for CAs | Raising domain | Commentary | Spending domain | Commentary | Classification |

|---|---|---|---|---|---|---|---|---|---|

| 1) Business Rate retention pilots |

Yes |

The Non-Domestic Rating (Rates Retention) and (Levy and Safety Net) (Amendment) Regulations 2017 |

Ability to retain 100% of Business Rates revenue growth locally. |

Only available in pilot areas – agreement over split between CA and constituent councils varies. |

Low - Moderate |

Cannot vary structure of the tax itself, but action to increase tax base will lead to higher revenues. |

Moderate |

In principle, pilot areas are free to spend as they wish. However, there have been offsetting reductions in other finance sources, meaning that there are existing spending pressures that will need to be met. |

B |

| 2) Business Rate supplement | No (forthcoming) | Business Rate Supplement Act 2009 and intended to be revised by Local Government Finance Bill 2016-17 (fallen). But MHCLG working to ensure that it will be extended to Mayoral CAs who agree that they want it. |

Ability to ask for additional 2p in the pound from local businesses to raise funds for projects to promote economic development (as already conferred on existing levying authorities). |

Only being extended to Mayoral CAs. Going through Parliament (June 2018) for WECA, C&PCA, LCRCA & WMCA. |

Low – Moderate |

Subject to consultation with local businesses and a local ballot. Can vary by up to 2p in the pound. Note that where more than one supplement is in place, combined value must not be more than 2p in the pound. |

Moderate |

Limited to infrastructure investment and consultation with businesses must outline how the money raised is going to be spent. |

B |

|

3) Mayoral |

No |

Local Government Finance Bill 2016-17 (fallen). No current intention to revisit. |

Ability to introduce a supplement on Business Rates (of up to 2p in the pound) to raise funds for infrastructure projects on a project that the authority is satisfied will promote economic development in its area. |

Only applicable to Mayoral CAs. |

Moderate |

Can raise supplement after consulting with affected businesses and issuing a prospectus. No need to ballot. Can vary by up to 2p in the pound. Note that where more than one Infrastructure Levy is in place, combined value must not be more than 2p in the pound. |

Moderate |

Can only be spent on the project to which the supplement relates or in paying off loans made for the project |

B |

| 4) Mayoral precept | Yes | The CA (Finance) Order 2017. | Available in Mayoral CAs with agreed and legislated devolution deal. | No formal variation in principle. All Mayoral CAs, apart from WECA, have same scope of powers. | Moderate |

Set by Mayor in agreement with leaders of constituent members of CA. Secretary of State retains power to require a referendum and set threshold limit. No limits were set in 2018/19. |

Moderate | Can only be used to fund Mayoral responsibilities. Budget needs to be agreed by constituent members. |

B |

| 5) Fire and Rescue (F&R) precept | Yes | The Combined Authorities (Finance) Order 2017. | Where CA has taken control of F&R responsibilities, precepts can be raised on Council Tax to fund these roles. | Only applicable where Mayor has taken on responsibility for F&R. | Low - Moderate | Set by Mayor in agreement with constituent members of CA. Note that this forms part of the General Mayoral Precept, rather than a precept in its own right. | Low | Limited to Mayoral functions, including F&R. | C |

| 6) Police and Crime Commissioner (PCC) | Yes | Combined Authorities (Finance) Order 2017. | Precepts can be raised on Council Tax to fund the role of the PCC. | Only applicable where Mayor also has PCC responsibility. | Low - Moderate | Set by Mayor and reviewed by the Police and Crime Panel. Secretary of State retains power to require a referendum – and sets threshold limit each year. | Low | Limited to functions of PCC. | C |

| 7) New 'Enterprise Zones' | No | Local Government Finance Bill 2016-17 (fallen). | As part of plan to introduce 100% Business Rate retention, some authorities were to be given powers (through regulations from Secretary of State) to exempt specific areas from calculations across the pooled area – in effect creating locally- determined Enterprise Zones where increased Business Rates are fully retained locally (and any losses also absorbed). | Would have been applicable within authorities as specified in Local Government Finance Act 2012 and amended by the fallen Bill. | Moderate | Allocation of Enterprise Zones would have allowed for use of tax increment finance. Boosting potential borrowing power of CAs. | Moderate | In principle, increased revenues could be spent as the CA saw fit. As this is likely to be tied to Tax Increment Finance – future funds would probably need to be earmarked for debt repayment. | C |

| 8) Strategic Infrastructure Tariff | No | Consultation: Supporting housing delivery through developer contributions. | This would extend current powers of Mayor of London to levy a Community Infrastructure Levy. It would be a charge (per square meter) on developers. | CAs | Moderate | Set by the authority and based on total level of development. | Low | Needs to be spent on providing necessary additional infrastructure required for the development or funding of a specific project. | C |

| 9) Transport borrowing powers – Combined Authorities | Yes | Conferred through Order establishing the CA, based on Local Government Act 2003 | CAs can borrow for spending transport-related projects in line with usual prudential rules that would be applied to Local Authorities. | All CAs | Moderate - high | In principle, this gives significant flexibility. However, borrowing needs to be financed in future – which requires certainty over future revenue streams. | Low - moderate | Borrowing limited to funding transport investment, but with control over where for transport. | B |

| 10) Borrowing powers - Mayoral CAs | Yes | The Combined Authorities (borrowing) regulations 2018 | Mayoral CAs have further borrowing powers to meet non-transport related CA responsibilities – for example economic regeneration or housing. | Available to all Mayoral CAs with agreed debt caps with HM Treasury | Moderate - High | In principle, this gives significant flexibility. However, borrowing needs to be financed in future – which requires certainty over future revenue streams. | Moderate | Borrowing limited to CA Functions (other than transport), but with control within those functions. | B |

| 11) Bus franchising powers | Yes | Bus Services Act 2017 |

Where applicable, CAs are able to set the rules for local bus services, including the routes, timetables and fares. Where this happens, Bus Services Operator Grant will be paid to the CA and the CA will need to pay for the running costs of any franchised services. CAs would also be able to raise revenue from bus fares. |

Current Mayoral CAs have this power (although the potential North of Tyne MCA will not). Non-Mayoral CAs can only do so with agreement from Secretary of State and with laying of regulations. Both require consultation. |

Moderate |

Grant funding is relatively fixed (TfL receive ~£93m a year). There is an opportunity to raise revenue (if chose to do so) – for example, TfL bus fares amount to ~£1.5bn a year. However (see “spending” – unlikely to be “extra” money – as funds service). |

Low | Whilst revenue raising power is significant – spending likely to be focussed on running / improving services. | B |

| 12) Road User Charging | Yes | Transport Act 2000 |

Allows for charges in respect of the use or keeping of motor vehicles on roads. |

Can be introduced by local traffic authority or Integrated Transport Authority and one or more local traffic authorities, for purposes of funding local transport plan. |

High |

Scheme is at the discretion of the traffic authority – can be set according to a range of criteria including time of day and type of vehicle. Can only be made if it appears desirable for the purpose of directly or indirectly facilitating the achievement of policies in the licensing authorities’ local transport plans. Central Government has power to require consultation / inquiry into |

Low - Moderate |

Revenues are strictly hypothecated for a period of at least ten years, for spending on delivery of local transport plan. After this hypothecation period spending must be on things that “offer value for money”, and the legislation provides for central Government to issue guidance. |

C |

| 13) Workplace Parking Levy | Yes | Transport Act 2000 |

Introduction of licensing scheme for workplace parking. |

Can be introduced by local traffic authority, for purposes of funding local transport plan. |

Moderate |

Levy can vary by a range of factors. Can only be made if it appears desirable for the purpose of directly or indirectly facilitating the achievement of policies in the licensing authorities’ local transport plans. Central Government has power to require consultation / inquiry into the scheme. |

Low - Moderate |

Revenues are strictly hypothecated for a period of at least ten years, for spending on delivery of local transport plan. After this hypothecation period spending must be on things that “offer value for money”, and the legislation provides for central Government to issue guidance. |

C |

| 14) Mersey Tunnels | Yes | Mersey Tunnels Act 2004 |

Toll for using Mersey Tunnels. |

Only available in LCRCA |

Low |

Can only ordinarily be raised by an amount linked to inflation (RPI). Further changes need agreement from Secretary of State. |

Low - Moderate | Part hypothecated for spending related to the tunnels. Any excess can now be used (since 2004 Act) to contribute to delivery of local transport | A |

| 15) Tyne Tunnels | Yes |

River Tyne (Tunnels) (Revision of Tolls) Order 2018, River Tyne (Tunnels) Order 2005(b). |

Toll for using Tyne Tunnels. |

Only available in NECA |

Low |

Can only ordinarily be raised by an amount linked to inflation (RPI). Further changes need agreement from Secretary of State and Order to be laid in Parliament. |

Low |

Completely ring fenced for running the tunnels or to contribute to tunnels’ reserve. |

D |

| 16) New taxes - eg Tourist Tax | No | N/A |

No existing basis for new taxes to be levied at a local level (including, but not limited to, CAs). Would require (Primary) Legislation, likely to be significant time before this is a viable option. Otherwise would need to be undertaken through voluntary agreement with industry / area impacted. |

N/A | High |

New local tax would (presumably) provide significant flexibilities for CAs to determine the rate and structure of the instrument. |

Moderate - high |

In principle, new taxes could be levied without specification of where it would be spent. However, in practice, to gain buy-in it is likely that revenue from new taxes would need to be attached to specific areas of expenditure. |

B |

| 17) Funding from constituent councils | Yes | Set out in Order establishing CA | The constituent councils must meet any reasonably incurred costs of the CA, for a set of activities prescribed in the Order. | Extent of responsibilities (and, such, scope of the funding requirement) varies between CAs. | Low | Determined with constituent councils. No certainty over future of funds. | Moderate | Scope of spending restricted by Order under which CA was established. | A |

| 18) Transport Levy | Yes |

Set out in Order establishing CA and Transport Levying Body Regulations (amendments). |

CAs that have taken on transport functions also have powers to charge a Transport Levy on their constituent councils. | For all CAs that are Transport Levying Body – level varies by CA and set by CA. | Low - moderate | Levy is set by the CA, but scale is determined by the extent of transport functions conferred to the CA – these are set out in the establishment order. | Low - moderate | Limited to spending on transport functions. | |

| 19)

Gain share /Investment Fund Grant |

Yes | Devolution deals |

First delivered through devolution deal with GMCA and Government, the fund was envisaged as being based on the increase in tax revenue driven by actions of the CA.

Deals agreed later moved to a notional concept of gain share, meaning that this has effectively turned into a yearly grant. |

Available in Mayoral CAs. The size of the grant varies between different CAs. The split between revenue and capital also varies between CAs. Also for WYCA – agreed in 2014 Growth Deal. |

Low |

Initially agreed over a 30-year period. However, this is subject to review by HM Treasury / MHCLG every five years with Secretary of State (MHCLG) deciding whether funding will continue. As such, there is no guarantee that it will continue. |

Low - moderate |

Part of Single Pot (see detail below)

Each CA is subject to scrutiny from HM Treasury on this spending and a full review over five years, meaning that the ongoing nature of the grant is not guaranteed.

There are restrictions over how (e.g. specifications between capital and revenue spending) and when (e.g. specific rules on timescales) the money is spent. |

A |

| 20) Transport Grant | Yes | Devolution deals |

The grant is made up of several existing funding streams, potentially including: a) intergrated transport b) Highways maintenence block (formula funding) c) Highways maintenence incentive funding d) National Productivity Investment Fund (2017/18 only) e) Pothole action fund |

Only available to Mayoral CAs Amounts and streams included vary by MCA |

Low | An amalgamation of existing funds - no extra revenue raising power. | Moderate | Part of single pot (see detail below) | A |

| 21) Transforming Cities Fund | Yes | Announced in Autumn Budget 2017 | A four-year, £1.7bn fund focused on improving intra-city connectivity in England’s City Regions. |

Mayoral CAs in existence at time of Budget received a total of £840m in fixed allocations, ranging from £59m to £250m. Non-Mayoral CAs (and SCRCA) are required to bid into the remaining £840m pot in a competitive process. |

Low |

Mayoral CAs receive fixed allocation, over a fixed time period. Non-Mayoral CAs will need to compete to get funds. |

Low - moderate |

Mayoral CAs can invest in strategic investment priorities, as determined by the CA. Likely to form part of the “Single Pot”. Non-Mayoral CAs need to have expenditure agreed through competitive process. |

|

| 22) Housing Investment Fund | Yes | Devolution deal | A loan from the Government which CA can use to lend to local developers to help them to fund quicker housing delivery in the local area. | Only available in GMCA. | Low | Amount fixed and agreed with central Government. | Low - moderate | Must be on housing. Recent changes have increased flexibility to recycle funds between years. | A |

| 23) Housing and Infrastructure Fund | Yes | Devolution deals | Competitive capital grant provided to LAs and CAs to acquire land, deliver physical infrastructure and invest in housing. | Available in CAs - amounts vary by CA | Low |

Competitive process – fund fixed to maximum of £2.3bn until 2021. CAs will need to be successful in bidding / negotiating with Government for grant. |

Low | Tied to specific projects. | D |

| 24) Land Remediation Fund | Yes | Devolution deals | Grant funding from Government to CA focussed on bringing brownfield land back into use for housing and employment. |

Available in GMCA and WMCA – but part of housing package, rather than as part of devolution / CA freedoms |

Low | Agreed with central Government as part of Devolution deal. Fixed over a given period of time. | Low - moderate | Specifically for remediation activity – but with flexibility within that category. | A |

| 25) Work & Health Programme funding | Yes | Devolution deal | Portion of national Work and Health Programme budget devolved to CA so that they can co-design and commission the service. |

Only available in GMCA (and London) – devolution deal agreed the devolution of control over funding for the Work and Health Programme. |

Low | Determined nationally (and matched through European Social Fund). | Low | Ring-fenced for Work and Health Programme. No flexibility apart from over who to commission. | D |

| 26) Apprenticeship Grant | No | Devolution deals | A grant devolved as part of Devolution deals, however national scheme is now closed. | Amounts vary by Mayoral CA | Low | Fixed amount from central Government | Low | Mayoral CAs had ability to design criteria, but within fairly tight constraints. | D |

| 27) Life chances fund | Yes | Devolution deal 2016 | Bringing together of existing funding streams (e.g. national Troubled Families programme, Life Chances Social Investment Fund) into one coordinated pot. | Only available in GMCA | Low | Fixed amount from central Government. | Moderate | The CA will agree with the Government what the fund should achieve, and must make sure that the fund is spent to deliver these agreed outcomes. Within this, GMCA will be able to make their own investment decisions. | A |

| 28) Local Growth Fund | Yes | Devolution deals |

A competitive fund for Local Enterprise Partnerships and council partners to invest in projects to improve each CA. The LGF is made up of a range of different funding streams, including ‘flexible’ funding that can be spent on a range of local growth priorities, and funding for particular projects. |

Available to CAs where CA and LEP have agreement to do so / CA is the accountable body | Low | Fixed amount from central Government. | Moderate | Where available to Mayoral CAs it forms part of Single Pot (see below for detail). | A |

| 29) Health & Social Care | Yes | Devolution deal | More influence over £6bn spending in City Region each year, and £450m of “Transformation Fund” up to 2021. | Only for Greater Manchester | Low | Existing funds – no extra revenue raising power | Moderate - high | Spending limited to health and social care – but this is a large, important and high priority area. | A |

| 30) The Single Pot | Yes | Devolution deals | A single pot, bringing together a variety of existing budgets, including transport grants, with flexibility to move funding between different types of projects and spend in different years, to support the local economy. | Available to Mayoral CAs. Existing budgets that are brought together to form the single pot are different for some CAs. | Low | An amalgamation of existing funds – no extra revenue raising power. | Moderate |

Spending subject to Single Assurance Framework agreed between CA and MHCLG.

However, individual elements (e.g. LGF and Investment Fund Grant) of pot may also be subject to continued scrutiny under existing arrangements for each element, meaning that flexibility is more limited than name implies |

A |

| 31) Adult Education Budget | No | Devolution deals (and secondary legislation) | Brings together funding for adult education, outside of apprenticeships and loan funding for higher-level skills provision; Community Learning; and Discretionary Learner Support (help with extra costs to overcome barrier to learning). | Will be available for Mayoral CAs. | Low | An amalgamation of existing funds – no extra revenue raising power. | Moderate |

Spending potentially limited to adult education – but with flexibility within that. |

A |

| 32) Mayoral Capacity Fund | Yes | Budget 2017 | £1m a year revenue grant for 2018/19 and 2019/20 for MCAs to boost capacity. | Available to Mayoral CAs. | Low | Grant funding – but a small amount. | Moderate | Spending limited to boosting the new mayors’ capacity and resource. | A |

Commentary: Financial freedoms available

When looking at Table 2, it is immediately apparent that there are not currently a set of freedoms in place that would match the description in the quote provided at the start of Section 2, which is: ‘…the ability to manage a single pot of funding with maximum flexibility on a multi-year basis, without intervention from Government.’ In short, with each of the freedoms currently available, there tends to be an extent of central government control over either the raising domain or the spending domain, or both these domains.

This is typically a result of the legislation that underpins the particular freedom or the negotiation with central government. For example, a number of the available freedoms are limited by statute on the spending domain to being used to fund transport infrastructure investment. Equally, devolution deals have placed limits on both the raising and spending domains, for example by having made explicit agreements about the scale of grant funding available to CAs to spend on a specific area (eg land remediation).

In this sense, to date, it is perhaps more appropriate to consider CAs as having financial control, rather than financial freedom. In other words, they have some control over how money is raised in order to meet a certain function, or they have some control over how the money is spent, within broad functional envelopes, once it has been raised. They do not have freedom to do both of these things together. Some key examples are highlighted below.

Gain Share / Investment Fund Grant

In all mayoral CAs, apart from GMCA, Gain Share (or Investment Fund Grant) is an amount agreed between central government and the CA as part of the devolution deal. It can then be used to meet the functions of the Mayor’s office. This means that it ranks “low” on the raising domain and “moderate” on the spending domain; there is no local control over how the money is raised, but there is some local control, within broad boundaries agreed with central Government, over how the money is spent.

Road User Charging

Combined authorities (CAs) which act as the local traffic authority have the power to introduce a Road User Charging scheme. The nature of the scheme can be determined by the CA, and there are a wide range of different schemes (with different rates and overall revenues) that could be envisaged. However, the revenue can only be used to fund projects as part of the local transport plan. This means that it ranks “high” on the raising domain, but only “moderate” on the spending domain; there is local control over how the money is raised (and who from) and some local control over how the money is spent, again within broad boundaries agreed with central government.

Mayoral Precept

All mayoral CAs also have the power to raise a Mayoral Precept on Council Tax with the exception of the West of England Combined Authority. Overall, this freedom has been classified as “moderate” on both the raising and spending domains.

Spending freedom is limited by central Government to areas over which the mayor has authority. This does represent some constraint (although noting that the areas of responsibility can be viewed quite broadly).

It is important to note, however, that any limitation on the raising domain is yet to be determined, as the Secretary of State sets threshold limits for specific precepts each year and these can vary. In 2018/19 (the first year of potential Mayoral Precepts) no limits were set on Mayoral Precepts, however (as shown below) only one Mayoral Combined Authority (GMCA) elected to use their precepting powers.

It is also important to note that, while assessed as “moderate” on both domains, Mayoral Precepts could play an important role in opening up the possibility of using more financial freedoms. This is because Mayoral Precepts could provide a reliable and consistent source of revenue for mayoral CAs.

Given the relatively stable nature of the council tax base, this revenue source could also be used to open up the opportunity for borrowing. This could be particularly attractive given the relatively small number of alternative revenue streams “owned” by mayoral CAs.

Variation in freedoms

It is also apparent that CAs have not all been granted the same financial freedoms; both in terms of the fiscal instruments that they have access to; and the extent of control over spending which they have.

The most obvious distinction is between mayoral and non-mayoral CAs, where mayoral CAs have been granted wider freedoms on both the raising and spending domains. On the raising domain, examples include the Mayoral Precept, the power to borrow and (once legislation has passed) raise business rates to meet Mayoral priorities. On the spending domain, an obvious example is the Single Pot where existing streams of grant funding are combined into a single budget to provide more flexibility. The rationale here is clear; the Government has devolved policy and delivery responsibilities in a range of areas covered by the mayors and, alongside these, financial freedoms have been granted in an attempt to provide the necessary flexibility for mayors to meet their local priorities.

There are also distinctions between the mayoral CAs. In particular, GMCA already has a wider range of financial freedoms available to it than other mayoral CAs. For example, in GMCA:

-

- The Mayor has taken over the responsibilities of the Fire and Rescue Services and the role of the Police and Crime Commissioner. Each of these roles/responsibilities come with the power to raise a precept that can be used to fund all or part of these responsibilities.

- GMCA has been provided with a housing investment fund (loan from central Government to meet housing plans), which has not, as yet, been made available to other CAs.

- A larger range of existing grants have been combined within GMCA, including through the Life Chances Fund, and it has been given more influence over health and social care spending.

Falling of Local Government Finance Bill

To some extent, progress on CA financial freedoms has been stymied by the falling of the Local Government Finance Bill 2016-17. Had it received Royal Assent, this would have enabled mayoral CAs to raise Business Rates to fund infrastructure investment (without the need for a local ballot). As this report is written, steps are being taken to ensure that the powers to raise Business Rate supplements (albeit with a local ballot) are likely to be granted to mayoral CAs in 2018. Secondary legislation is currently being taken through Parliament for West Midlands Combined Authority, Cambridgeshire and Peterborough Combined Authority, Liverpool City Region Combined Authority and the West of England Combined Authority.

Use of financial freedoms

The use of financial freedoms is not just about the freedom being available. It is also clear that, even when they are uniformly available across CAs, there can be variation in both the practical nature of freedoms (for instance size of grant) and the specific use of the freedoms (including whether and how the freedoms are actually used in each CA).

Table 3 builds on Section 3 to outline more detail of the nature of the freedoms available in each of the CAs and a summary of whether the freedoms have been used.

| Financial freedom | CPCA | GMCA | LCRCA | NECA | SCRCA | TVCA | WMCA | WECA | WYCA |

|---|---|---|---|---|---|---|---|---|---|

| Business Rate retention | No | Yes | Yes | No | Yes | No | Yes | Yes (5% allocated to CA) | No |

| Business Rate supplement | No basis – but legislation expected | No basis – but legislation expected | No basis – but legislation expected | Not applicable - no mayor | No basis – but legislation expected | No basis – but legislation expected | No basis – but legislation expected | No basis – but legislation expected | Not applicable - no mayor |

| Mayoral Infrastructure Levy | No basis – needs legislation | No basis – needs legislation | No basis – needs legislation | Not applicable no mayor | No basis – needs legislation | No basis – needs legislation | No basis – needs legislation | No basis – needs legislation | Not applicable - no mayor |

| Mayoral precept | Yes - not used | Yes - £8 for Band D property. £6.6m in 2018/19 | Yes - not used | Not applicable no mayor | Yes - not used - no opp yet | Yes - not used | Yes - not used | No | Not applicable - no mayor |

| Other precepts - fire and rescue (F&R), police and crime commissioner (PCC) | No | PCC, F&R | No | No | No | No | F&R - No PCC - needs legislation |

No | No |

| New Enterprise Zones | No basis – needs legislation | No basis – needs legislation | No basis – needs legislation | No basis – needs legislation | No basis – needs legislation | No basis – needs legislation | No basis – needs legislation | No basis – needs legislation | No basis – needs legislation |

| Transport Borrowing power - CAs | Available | Available | Available | Available | Available | Available | Available | Available | Available |

| Non-transport borrowing powers | Powers granted in May 2018 | Powers granted in May 2018 | Powers granted in May 2018 | No | No | Powers granted in May 2018 | Powers granted in May 2018 | Powers granted in May 2018 | No |

| Bus Franchising powers | Not used | Not used | Not used | Not used | Not used | Not used | Not used | Not used | Not used |

| Road User Charging | Not used | Not used | Not used | Not used | Not used | Not used | Not used | Not used | Not used |

| Workplace Parking Levy |

Not used |

Not used | Not used | Not used | Not used | Not used | Not used | Not used | Not used |

| Mersey Tunnels | NA | NA | £41m 2018/2019 | NA | NA | NA | NA | NA | NA |

| Tyne Tunnels | NA | NA | NA | £26m 2018/19 | NA | NA | NA | NA | NA |

| New taxes eg tourist tax | No basis – needs legislation | No basis – needs legislation | No basis – needs legislation | No basis – needs legislation | No basis – needs legislation | No basis – needs legislation | No basis – needs legislation | No basis – needs legislation | No basis – needs legislation |

| Funding from constituent | £0m | £0m | £6.2m 2018/19 | Not clear | Not clear | Not clear | £1.8m 2018/19 | £0m | Not clear |

| Transport Levy | £0m (becomes available in 2019/20) | £279.20m 2018/19 | £98.5m 2018/19 | £83.65m 2018/19 | Not clear | Not clear | £114.7m 2018/19 | £14.67m 2018/17 | £100m 2018/19 |

| Gain share/Investment fund grant |

£20m per year for up to 30 years. 40:60 revenue: capital split |

£30m per year for up to 30 years. Variable over time. |

£30m per year for up to 30 years. 25:75 revenue: capital split |

NA |

£30m per year for up to 30 years. 40:60 revenue: capital split |

£15m per year for up to 30 years |

£36.5m per year for up to 30 years |

£30m per year for up to 30 years | £30m per year for up to 20 years |

| Transport Grant | £22.55m per year until 2021 | Linked to Business Rate Retention pilot | £26.51m per year until 2021 | NA | NA | £13.93m per year until 2021 | £33.46m per year until 2021 | £17.57mm per year until 2021 | NA |

| Transforming Cities Fund | £74M | £243M | £134M | Need to apply | Need to apply | £59m | £250m | £80m | Need to apply |

| Housing Investment Fund | No | £300m over ten years | No | No | No | No | No | No | No |

| Land Remediation Fund | No | Potentially £50m | No | no | No | No | £200m over ten years | No | No |

| Work & Health Programme funding | No | £52m (split between UK Government and ESF) for five years of the programme | No | No | No | No | No | No | No |

| Apprenticeship Grant | National scheme now closed | National scheme now closed | National scheme now closed | National scheme now closed | National scheme now closed | National scheme now closed | National scheme now closed | National scheme now closed | National scheme now closed |

| Life chances fund | No |

Up to 2020: £35m – Troubled Families £6m – expansion of Working Well pilot £5m – Life Chances Social Investment Fund £40m from Greater Manchester Councils |

No | No | No | No | No | No | No |

| Local Growth Fund |

Controlled by CPCA, though with recommendations from Business Board (which has replaced LEP). Business Board and CA geography is not aligned. Consultation on final governance structure currently underway |

‘flexible’ element - £406.6m 2016/7- 2020-21 |

‘flexible’ element - £247.56 2016/7-2020- 21 |

Controlled by LEP | Controlled by LEP |

‘flexible’ element - £103.129 2016/7-2020- 21 |

Controlled by LEP | Controlled by LEP | Controlled by LEP |

| Health and Social Care | No |

As member of GM Health & Social Care Partnership Board, more control over £6bn spending in City Region each year, and £450m of “Transformation Fund” up to 2021 |

No | No | No | No | No | No | No |

| The Single Pot | Transport Grant, Investment Fund, Adult Education Budget [AEB] (when implemented) | Transport Grant, Investment Fund, ‘flexible’ element of LGF, AEB (when implemented) | Transport Grant, Investment Fund, ‘flexible’ element of LGF, AEB (when implemented) | NA |

NA |

Transport Grant, Investment Fund, LGF, AEB (when implemented) | Transport Grant, Investment Fund, AEB (when implemented) | Transport Grant, Investment Fund, AEB (when implemented) | NA |

| Adult Education budget | TBC | TBC | TBC | NA | TBC | TBC | TBC | TBC | NA |

| Mayoral Capacity Fund | £1m a year for two years | £1m a year for two years | £1m a year for two years | No | No | £1m a year for two years | £1m a year for two years | £1m a year for two years | No |

Commentary: use of freedoms

Overall, Table 3 demonstrates that there are significant differences between combined authorities (CAs), both in how freedoms are structured in practice and how or whether the freedoms are actually used.

Variation in freedoms

Mayoral Precept

Whilst available to all mayoral CAs (apart from the West of England Combined Authority, whose devolution deal did not allow for a Mayoral Precept), only one mayoral CA (Greater Manchester – see box 1) has chosen to levy a Mayoral Precept on council tax to provide finances for mayoral functions. For the other mayoral CAs, the decision not to levy a mayoral precept this year was the result of a number of local factors including: agreement to utilise alternative sources of finance for the coming year, Mayors being elected on a manifesto of not using precepting powers (eg Tees Valley), or concerns about the impact of a precept on residents during a period of continued pressure on real wages.

Box 1: Greater Manchester Combined Authority’s use of Mayoral Precepts

The Mayor of GMCA has the power to levy two precepts on Council Tax bills. These cover functions taken on from the previous Police and Crime Commissioner and the General Mayoral Precept that covers Fire and Rescue Services and any additional funding for the Mayor’s functions.

The table below outlines the per household cost of each of these elements in 2018/19. The Mayoral Precept and Fire and Rescue Services Precept are part of what has been called the “Mayoral General Precept (including Fire Services)” and this was set for the first time in 2018/19. The Precept set for PCC functions was increased by £12 for a band D property (the maximum allowed before triggering a referendum) and the Precept for Fire and Rescue functions was frozen.

Table: Precepts levied by the Mayor in Greater Manchester Combined Authority (2018/19)

|

|

Property's Council Tax band |

|||||||

|

Precept |

A |

B |

C |

D |

E |

F |

G |

H |

|

|

£ |

£ |

£ |

£ |

£ |

£ |

£ |

£ |

|

Fire and rescue |

39.96 |

46.62 |

53.28 |

59.95 |

73.27 |

86.59 |

99.91 |

119.9 |

|

PCC Functions |

116.2 |

135.57 |

154.93 |

174.3 |

213.03 |

251.77 |

290.5 |

348.69 |

|

Mayoral |

5.33 |

6.22 |

7.11 |

8.00 |

9.78 |

11.56 |

13.33 |

16.00 |

|

Total |

161.49 |

188.41 |

215.32 |

242.25 |

296.08 |

349.92 |

403.74 |

484.59 |

In total, the Mayoral General Precept will raise £49.92 million in 2018/19. Of this, £6.61 million is from the Mayoral element and £43.3 million from the Fire and Rescue Service element. The Mayor’s budget, including figures for the Mayoral General Precept was submitted to CA leaders in January 2018 and following discussion, the Mayoral element was reduced (by the equivalent of £1 for a band D property). The Mayoral Police and Crime Commissioner Precept will raise £128 million.

Gain Share / Investment Fund Grant

There are also variations in the specification of freedoms that have been provided to all or many CAs. For example, all mayoral CAs have been provided with Gain Share/Investment Fund Grant as part of their devolution deals, however in practice, the nature of these are different across the CAs.

A key difference is the allocation between revenue and capital funding. Most mayoral CAs have grants weighted towards capital funding, with a range between 25 (revenue):75 (capital) for Liverpool City Region Combined Authority and 40 (revenue): 60 (capital) for Sheffield City Region Combined Authority. However, it is worth noting that both the original proposed North East Combined Authority Devolution Deal and the prospective deal for North of Tyne have 100 per cent revenue funding. Interviewees with higher requirements on capital spending noted that this significantly limited the effectiveness of the funding in terms of being able to meet local needs and leveraging additional finance.

As the latter sections of this report show, our interviews have revealed a number of reasons for this. A prime driver is that many CAs, and the freedoms which they can use, are still in their infancy. They have also evolved sporadically over time, through a number of different pieces of legislation and devolution deals.

In this situation, it is not surprising that some amount of time is needed to see the full impacts of the freedoms that have been granted. Over time, we would expect that more of the freedoms that are currently available will be taken up and we hope that this report provides a helpful resource as this work is taken forward.

Freedoms yet to be used

The table also highlights that, as well as the lack of use of the Mayoral Precept, a number of the other headline freedoms have not yet been used. As shown below, one of the main drivers of this is the fact that a number of these freedoms have only just been granted and it will take time for CAs to develop strategies and detailed financial (and delivery) plans for how they will be used in the future. Key examples include:

Bus franchising

Powers over bus franchising were provided in the Bus Services Act 2017. All existing Mayoral CAs have been granted automatic access to franchising powers (although the potential North of Tyne Mayoral Combined Authority will not, as transport powers are held across the North East region) and other CAs can access powers with agreement of the Secretary of State and subsequent legislation.

Whilst none of the CAs have yet to develop a bus franchising scheme, this is hardly surprising given the legislative (and contractual) requirements around consultation and the publication of an assessment of the scheme (see Box 2). However, a number of mayoral CAs have already signalled their intent to develop plans for a scheme (eg Greater Manchester Combined Authority has already commissioned an assessment for a new scheme, and Liverpool City Region and Cambridge and Peterborough Combined Authorities are both undertaking strategic reviews of local bus services, including the consideration of a franchising scheme) or have outlined details of the circumstances under which they would consider developing a scheme (eg West Midlands Combined Authority).

The potential for these schemes is significant. They could provide the opportunity to coordinate bus services across the CA, potentially providing better, more efficient, cheaper and more reliable links for people to access jobs, housing, education, healthcare and a range of social activities. They also give CAs greater financial control. This comes with risks, but also opportunities; Transport for London (TfL) receives around £1.5 billion a year in fares through their franchised bus services. Combined with fares from the tube network, this provides a significant and stable revenue stream through which TfL can use to secure borrowing and undertake strategic investment across the network.

Box 2: Assessment of bus franchising schemes

The Bus Services Act 2017 outlines that the CA seeking to introduce a bus franchising scheme must produce an assessment that:

- describes the effects that the proposed scheme is likely to produce

- compares making the proposed scheme to one or more other courses of action.

The assessment must also include consideration of:

- whether the proposed scheme would contribute to the implementation of the local transport plan and/or the implementation of neighbouring authorities’ local transport plans

- how the authority or authorities would make and operate the proposed scheme

- whether the authority or authorities would be able to afford to make and operate the scheme

- whether the proposed scheme would represent value for money

- the extent to which the authority or authorities are likely to be able to secure that local services are operated under local service contracts.

The assessment must then be audited by an independent person, before any decision is made. Guidance on this assessment and the auditing and consultation process has been published by the Department for Transport (see DfT, (2017), The Bus Services Act 2017 - Franchising Scheme Guidance. DfT, London.

Borrowing

The other main freedom yet to be used is the ability to borrow to fund Mayoral priorities. Again, these powers have only recently been granted and frameworks / limits agreed with HM Treasury. As such, it is unsurprising that these have not yet been extensively used. In future, this freedom would be an obvious way in which to fund long-term investments to deliver Mayoral priorities.

However, a note of caution was raised by a number of those interviewed for this project (see more detail in Section 5). This was that borrowing was only a feasible option with a steady and guaranteed revenue stream through which repayments could be financed in future. With very few current revenue streams provided to CAs, those interviewed felt that borrowing powers were, in practice, fairly constrained. Even those authorities in receipt of significant revenue-based Investment Fund Grant and/or Local Growth Funds highlighted that these were only committed in the short term,

meaning that they were not something against which they could secure long-term borrowing or develop strategic plans. This concern was amplified by the fact that the constituent members of each CA would have to take the burden of future debt if CA revenue streams were not secured.

As such, the full power of the freedom to borrow to fund CA priorities (and indeed, borrowing for transport investment more generally) would only be realised once other existing freedoms had been taken on (eg Mayoral Precept, bus franchising, workplace parking levy and/or Mayoral Business Rate Supplement) or new freedoms granted (eg power to raise new taxes like a tourist tax, or other ways of capturing value of future development, like retention of “additional” Stamp Duty Land Tax).

Lessons learned

Over the course of this project, the team undertook 15 in-depth semi-structured interviews with senior officers from combined authorities (CAs), civil servants in central government and experts in local government finance and devolution. As well as contributing to our understanding of the range of financial freedoms currently available to CAs, and how they are used, these interviews allowed us to gain insight into a range of questions. These included:

- The challenges faced by CAs in operationalising the financial freedoms currently available to them.

- Where financial freedoms had been utilised, the lessons learned from this experience.

- Appetite for more financial freedoms.

- Areas where relatively small changes to the existing freedoms would make them easier to use or more effective.

These interviews were held confidentially, so it is not possible to fully summarise the findings of them. However, the insights gained from them have fed into the observations throughout the report and our recommendations for next steps on fiscal freedoms in Sections 5 and 6. The main themes are summarised briefly below.

Financial freedoms available are only a small step away from fiscal centralism

The majority of interviewees acknowledged that the range of fiscal freedoms available to them had increased over the last 10 years. However, it was also noted that the UK is starting from a system that is unusually fiscally centralised and that, while progress has been made, there has been only a small step towards addressing this fiscal centralism. It was also felt that the range of freedoms currently available had not met Government’s stated ambitions since 2010.

There are also important differences in the freedoms that have been given and the practicality of their use. For example, there are differences in splits of funding between capital and revenue grants, which have important implications for the extent of spending freedom for CAs. It is also clear that Greater Manchester is using its accumulated experience to make more of the freedoms available than any other CA (and has been granted a wider range of freedoms).

It can be challenging to use existing powers effectively

Whilst there are a range of freedoms available, the majority of interviewees agreed that it could be challenging to use these powers in practice. There are a number of reasons for this:

- Uncertainty of future funds: Significant challenges were faced because grants (eg Local Growth Fund, Investment Fund Grant) lack certainty into the future and the majority of CAs have limited revenue sources. This means that it is hard to make meaningful plans for the future, which is particularly challenging when considering large scale infrastructure investments. This has also reduced the viability of borrowing to invest, since CAs have a lack of clarity over their ability to service future debt repayment.

- Restrictions and monitoring are counterproductive: It was noted that a number of streams of funding (particularly grant funding) come with significant requirements over how and when the money is spent. For instance, splits between revenue and capital have been set and restrictions placed on the ability to roll over funds between years. Whilst this might make accounting sense for central government, it was argued that it led to short termism and squeezed out strategic

thinking in local government. It also made it more difficult to structure investment to meet local priorities, as central government came with a set view about how the money should be spent.

- Sometimes not fit for purpose: A related point was that the restrictions placed on the use of grants (and funds from other financial instruments) sometimes meant that, in practice, they were not too helpful. For example, restrictions on the focus of the spending (on particular types of projects or functions) could mean directing available resources towards an area that central government deemed a priority, rather than those which had been locally determined as priorities. The same is also true of distinctions between capital and revenue, which many interviewees felt was unhelpful as it put pressure to spend on short-term projects to meet pressure from central government, rather than on local priorities (which may be classed as either capital or revenue).

- It takes time: Many CAs are planning to use existing freedoms, however, either powers have only just been granted or it is too early in their life cycle to have managed to implement strategies to utilise them. Prime examples include bus franchising and borrowing for Mayoral priorities. Another clear example is Sheffield City Region Combined Authority where a Mayor has only just been elected. The experience of GMCA was also noted; their use of financial freedoms has been developed over decades of joint working and capability building. It was acknowledged that it would be likely that many new Combined Authorities would take a number of years to develop capabilities and use flexibilities in the same manner as GMCA.

Catch 22 of resourcing

Most interviewees thought that CAs had, or could find, the necessary expertise to take forward financial freedoms. However, there was a distinct challenge that it was hard to justify hiring expertise into finance teams before financial freedoms were in use. This meant that, without the upfront investment in the expertise to develop the strategy and business case, it was then challenging to make a compelling case for the use of freedoms.

A similar argument was made more generally about the size of mayoral and CA offices. In general, these are currently very small, which means that there is limited capacity to think beyond day-to-day priorities and to develop significant programmes of long-term strategic work. A comparison was made with Greater London, where the GLA has a staff of over 800, which enables them to actively engage across a wide range of policy areas. Again, it was recognised that it would take time to develop this sort of capacity and the benefits of expanding Mayoral offices would need to be effectively communicated to ratepayers and wider stakeholders. To some extent, allocations from the Mayoral Capacity Fund could address these concerns, however, with this only lasting two years and being relatively small, there is still the question of how any expansion could be funded in the longer term. More broadly, it also needs to be considered that future recruitment will need to be considered in the context of significant other calls on talent, including from major national infrastructure development programmes and the relocation of major UK businesses, from London to other parts of the UK.

Make the most of what we have, then move on

When thinking about the future, a number of interviewees argued that before pushing for further freedoms, there would need to evidence the fact that they had “maxed out” existing freedoms and that this had led to significant benefits. Without this evidence, they acknowledged that central Government could be reticent to provide further flexibilities.

Stable and guaranteed revenue is vital

As highlighted above, a major concern was the lack of stable, predictable revenues. This significantly limits CA freedom as they are unable to commit to long-term plans for investment or borrowing. As well as creating uncertainty, it was argued that this fed through into costs, as potential partners and creditors factor this uncertainty into their charges.

As well as limiting borrowing powers, this also means that the CA is completely reliant on its constituent members for financial viability. In short, if the CA takes on borrowing, without a long-term revenue stream (eg Mayoral Precept) it will be the responsibility of the constituent councils to meet the costs of repaying this if existing CA revenue streams were to stop or reduce. This understandably makes respective councils more risk averse than they might otherwise be and, given that budgetary decisions need agreement of the councils, it makes it hard to deliver ambitious plans for the CA.

Freedoms do not always mean use

An important point that was made several times was that the freedom not to use a certain fiscal instrument was as important as the freedom to do so. In particular, a number of interviewees noted that a decision not to use the Mayoral Precept by their CA was, in itself, an example of exercising a financial freedom.

It was also recognised that, as well as accountability to local residentsCAs faced a dual accountability to both their constituent members and to central government. In a context where both national and local politics are currently challenging, this puts CAs in a difficult position in terms of their ability to use the available freedoms.

In particular, there was a perception that central government was simply passing down the difficult political decisions (for example on meeting clean air limits) to councils and CAs. But, with council taxes rising and on-going restraint in the national finances, there was significant pressure on local government to limit the extent of rises in both council tax and business rates. This makes raising revenue for local priorities difficult.

Over time, if freedoms are to be used effectively, this challenge would need to be met. To do so, it will be important to make a compelling case for the benefits that raising revenue could bring to businesses and residents over the longer term.

Short-term priorities for change

Overall it is clear that the system of government finance in the UK remains highly centralised. Reforms since 2010 have improved the range of freedoms available to local areas, including mayoral and non- mayoral CAs. However, there has been an inconsistent approach to how the freedoms have been provided in practice (for example, there are differences in requirements on capital: revenue splits of Investment Fund Grants). Combined with freedoms already available to councils, Local Enterprise Partnerships (LEPs), Police and Crime Comissioners (PCCs) and Fire and Rescue Services (to name a few), this has also left a rather complex web of fiscal freedoms available across the country.

Overall, this has meant that the ambition of these reforms has not been realised in practice. We also believe that there are significant opportunities for further fiscal devolution to CAs to be used to support central government’s policy agenda, for example in achieving ambitious house building targets.

This section outlines a range of activities that could be taken forward (or at least started) within the next 6 – 18 months to make more of existing freedoms. It also provides a set of proposals for central government for how freedoms could be improved or extended.

Extending and improving existing freedoms

During the course of this project, we have identified a range of specific areas where existing freedoms could be improved or slightly changed to ensure that they function more effectively. These include:

- Removing restrictions on revenue/capital splits in the Investment Fund Grant.

- Further relaxing requirements within the “Single Pot”, so that all money within it is completely flexible both over function and timing of expenditure.

- Extending the timeframe of the Investment Fund Grant and/or Local Growth Fund allocations, for example, making the next agreements over a ten-year period (rather than five).

- Committing to the continuation of the Mayoral Capacity Fund over the course of the next Spending Review.

- (As above) Seeking a Presumption in Favour of CA Financial Freedoms, to ensure that all existing freedoms are opened up to all CAs and that any new freedoms are automatically granted to all CAs, unless there are specific reasons not to.

Increasing the use of existing freedoms

Use of Road User Charging and / or Workplace Parking Levy

None of the CAs are currently using Road User Charging or a Workplace Parking Levy (WPL). However, a number of areas are considering or have considered this option. For example, there have been recent discussions on the WPL at a city council level in both Manchester and Cambridge. This has particularly been considered with reference to the need for local areas to meet legal limits of local air pollution.

Within this context, the approach was rejected in Manchester. This is perhaps unsurprising given the congestion charge referendum in 2008, and strong arguments that central government should not be “passing the buck” for meeting the legal limits.

However, while not necessarily the answer to meeting legal limits of local air pollution, such schemes could be an area to explore to deliver a significant financial freedom and a source of revenue to invest in local transport plans. It is also possible that central government would be attracted to discussions on how these powers could be used; given the predicted loss of revenue from Fuel Duty and Vehicle Excise Duty in coming years, HM Treasury are keen to explore alternative forms of vehicle taxation.

There is also existing evidence that the schemes can be implemented successfully:

- As part of the research for this project, the team interviewed senior officers in Nottingham Council, who have successfully introduced such a scheme. It has raised £44 million in the first five years and is generally supported by businesses as they have seen the benefits the investment has led to. A case study is provided in box 3.

- The Dart Charge (for using the Dartford Crossing in London) is now based on the legislation underpinning Road User Charging (Transport Act 2000).

We believe that there is potential value in further work looking at the role of Road User Charging and/or a Workplace Parking Levy as a powerful financial freedom for CAs.

Box 3: Detail of the Workplace Parking Levy scheme in Nottingham

The Workplace Parking Levy (WPL) is a charge paid by employers in Nottingham who provide workplace parking spaces. A key driver of the WPL’s introduction was the economic cost of congestion in Nottingham, the large majority of which is created by car commuters at peak travel times. The main aim of the levy, therefore, is to incentivise employers to encourage their car- commuting employees to switch to alternative modes of transport.

The legislation allowing for the WPL to be introduced was passed in 2000, but it wasn’t until 2012 that the first charges were levied in Nottingham. It was the Transport Act 2000 that enabled councils outside of London to impose a charge on workplace parking. In 2007 Nottingham City Council launched a consultation on introducing its own WPL, before the Department for Transport gave Nottingham consent for the scheme in 2009.

The WPL applies to all employers in the Nottingham City Council area, although with a variety of discounts and exemptions attached to it. A workplace parking place is defined as a parking place that is occupied by a motor vehicle used by an employee, regular business visitor, pupil or student. Employers with 10 or fewer places get a 100 per cent discount, as do emergency services, NHS frontline services and places for disabled blue badge holders. There are exemptions for customer places, fleet vehicle places and loading/unloading.

When the scheme began in April 2012 the charge was set at £288 per parking place a year and has been set at £402 for 2018/19 (with annual increases dictated by rises in the Retail Prices Index). There has been 100 per cent compliance of employers since year one – with the council having a focus on compliance, rather than enforcement – and approximately £44 million of revenue generated in the scheme’s first five years. It is up to the employer whether or not to reclaim some or all of the charge from employees (the cost of 53 per cent of all liable parking spaces were passed on to employees by employers in 2016).

By law, all funds arising from the WPL are ring-fenced for investment in the objectives of Local Transport Plan. As such, the WPL has paid for extending the tram network, redeveloping Nottingham Railway Station and improving and maintaining the city’s bus service. Fundamentally, the WPL has increased Nottingham’s public transport capacity and quality.

The WPL has also driven behaviour change. Since the introduction of the scheme, the number of liable workplace parking places has fallen and the number of employers with Workplace Travel Plans has doubled. One study showed that the WPL has had a statistically significant impact on congestion, with almost a third of the users of new tram lines having formerly used cars to make their trips.

All in all, the WPL has reduced congestion, increased revenue for public transport and encouraged better car park management.

Preparing the ground for those taking on powers

Within the context of the freedoms already available, we hope that this document is helpful for officers and leaders in areas looking to become CAs or who have recently become CAs / mayoral CAs. There are also existing guides available on the LGA website and previous commissioned work that provides detail of lessons learned in other CAs.

These will likely serve as a useful starting point. However, it would also be helpful for a set of more detailed guides to be created that outline the exact basis, scope and nature of each of the financial freedoms available to CAs alongside practical advice and guidance for how they might be implemented in practice. A process for developing this, alongside an understanding of both case studies of the use of existing powers and areas where policy development has already been undertaken, is outlined in the next section.

Delivering Government priorities in the medium term

Creating a road map for the future fiscal devolution

As well as short-term steps to improving and extending the existing range of freedoms available to combined authorities (CAs), we also believe that it is important to set out a road map for ensuring that the Government’s stated aims on devolution are met. This would ensure more autonomy for CAs to meet the needs and preferences of local residents and drive growth and improved living standards right across England.

To deliver this, we believe that central government must reinvigorate its approach to fiscal devolution and this should be driven forward by joint working between the CAs and Whitehall departments. We have outlined an approach below that could support the delivery of the short-term priorities outlined in Section 6, and develop further significant steps that can be taken towards fiscal devolution in the next two to ten years.

Joining up thinking across combined authorities