Developing a productivity evidence base for a Local Industrial Strategy

Across the country, Local Enterprise Partnerships (LEPs) and Combined Authorities (CAs) are currently working to develop Local Industrial Strategies that will help inform productivity growth in their areas. Local Authorities have a crucial role to play in this, being the places where businesses and economic assets are located, and as members of their respective LEPs and CAs.

Successful Local Industrial Strategies will include a strong evidence base that makes clear which parts of the economy are distinctive strengths for local areas, and how places can best increase productivity. Priorities set out in Local Industrial Strategies should use this evidence to underpin the logic model of each intervention. Evidence gathering should be built into interventions, so the understanding of local economic drivers is enhanced over time.

The starting point is to have a good understanding of the current evidence on productivity.

In the video below, Andrew Paterson, Deputy Director at the Department for Business, Energy and Industrial Strategy sets out the Department's approach to productivity and the key considerations for areas setting out plans to boost productivity through their LIS.

This module has been produced by Metro Dynamics and aims to help support local authorities and their partners in developing an evidence base on productivity that can inform the Local Industrial Strategy.

Jump to section:

1. What is productivity? (15 minutes reading)

Productivity is a central concept in developing a Local Industrial Strategy, but it is often discussed in an abstract way. We begin by defining productivity, understanding how it is measured and explaining the key differences between it and economic growth.

2. Building the productivity evidence base for Local Industrial Strategies (30 minutes video)

To present the case for your area in the LIS you will need to assemble an evidence base of local productivity data. In these videos, we provide step-by-step instructions on how to develop and present a LIS evidence base using publicly available data sources.

3. Engaging your business base (10 minutes reading)

To understand your region’s economy, economic data can only help so much. You will need to survey local businesses to dig into how they work, their priorities and their supply chains. In this section we provide an outline of the practical considerations for business engagement, an issue explored further in Module 2.

4. Turning evidence into intervention (10 minutes reading)

After you have assembled an evidence base, you will need to write your strategy. In this fourth section, we discuss how to use evidence to inform your project planning strategy.

If you have any questions about this module or wish to provide feedback, please contact the LGA team at [email protected].

1. What is productivity?

In this section, we explain the concept of productivity as it relates to businesses and places in clear terms and, in doing so, help you consider how your local authority can support the productivity of local businesses within your area.

We start by explaining what productivity is, how it is measured and the key differences between economic growth and productivity.

We will then look at recent productivity trends in the UK both prior to and after the recession of 2008. We will also explain what is meant by the “productivity puzzle”.

We then look at what productivity means for individual businesses. When we talk about ‘raising productivity’ we ultimately mean helping businesses to raise productivity. Therefore, it is important to understand what this means.

The final part of this section examines productivity from the perspective of place. Whilst productivity is driven by individual businesses, the environment within which organisations operate significantly impacts levels of efficiency. Here we cover some of the approaches to achieve and outline how to craft effective policy.

Defining productivity

Productivity is a summary indicator of economic performance that is used to compare countries, regions or sectors to one another. Since it is a summary, it conceals details of what makes it high or low - this detail is important when it comes to changing productivity.

There are various ways to measure productivity, but the most widely used is labour productivity. This stands for “the quantity of goods and services produced per unit of labour input”. This can be measured for a country, a region, a firm, a sector or even a person. Though not the only measure of productivity available, it is the easiest to understand and obtain.

At a local and regional level, economic output is measured using Gross Value Added (GVA), which in broad terms is the local equivalent of Gross Domestic Product or GDP.

This is represented by the following equation:

Productivity = GVA/Number of hours worked

We discuss this definition and how it is measured in greater detail in the next section.

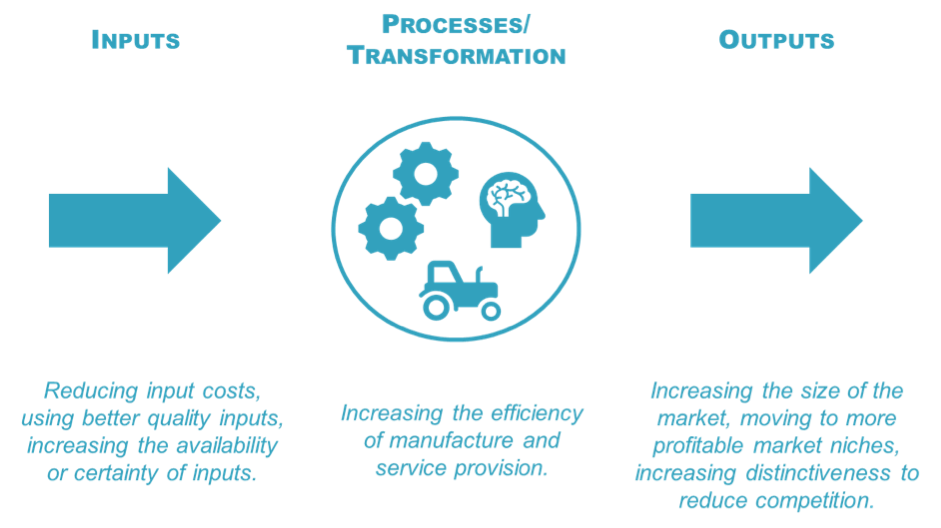

Another way of looking at productivity is that it is the difference between what is produced (output) and what is consumed (input). By this definition, a larger gap between your outputs and inputs results in higher productivity.

Productivity = Outputs - Inputs

This second definition is important when considering what productivity looks like from a business perspective, which we will discuss later on.

It is important to differentiate between economic growth (measured as the changes in GDP or GVA over time) from productivity growth. Economic growth refers to changes in the total size of the economy. In contrast, productivity is a measure of labour efficiency. Whilst size and efficiency are often linked through economies of scale, it is productivity which ultimately makes us better off.

Why is productivity so important?

Our previous section outlined how, unlike economic growth, productivity is a measure of efficiency. Producing equal or more outputs for fewer given inputs will make a country better off. Higher productivity can provide more money for welfare spending or higher wages. More productive economies are able to:

- Pay higher real wages

- Increase consumption and quality of life

- Raise more taxation revenue and therefore invest more in public services and build more infrastructure.

In the 20th and early 21st centuries, huge advances in productivity led to large increases in incomes and personal wealth amongst ordinary people in developed countries. This growth in productivity was based on improved access to and participation in education, greater meritocracy in the workplace, improved management and organisation, investment in critical infrastructure, and advances in technology.

And crucially, these productivity increases created widespread benefits. Increased productivity meant that people could get more work done in less time; it improved the way people worked and helped businesses allocate resources to more efficient uses.

This is illustrated by the high standards of living enjoyed by developed nations relative to developing countries. A bus driver in England isn’t paid more because they are more skilled than a bus driver in Nigeria. The English bus driver is paid more because they live in a more productive economy where the productivity of other sectors increases the wealth and incomes of all participants in the economy.

In contrast, low productivity negatively impacts current and future standards of living. This has both economic and social consequences. The Government’s new Industrial Strategy focuses on raising productivity and subsequent earning power. Low productivity is a major threat to the economy given its direct link with weak economic growth, stagnating real wages, lower consumption, declining health, poor infrastructure, reduced public services and a fall in national competitiveness.

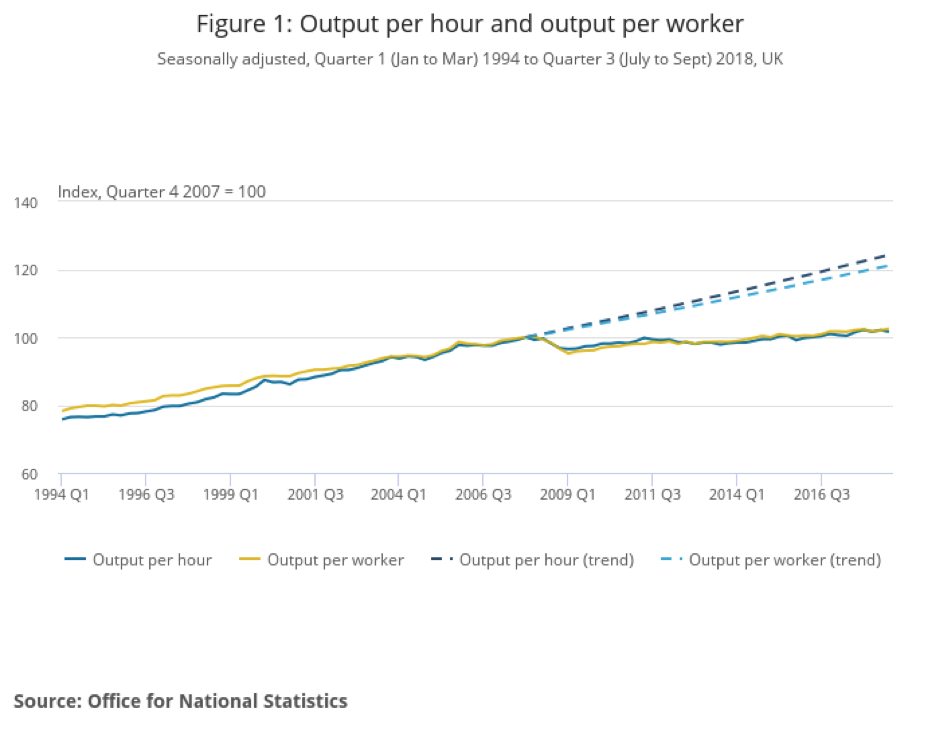

The UK’s Productivity Puzzle

The graph illustrates that since the economic crisis of 2008, productivity growth has stalled. After the crash, productivity growth dropped in all the G7 countries, but the UK has failed to recover at the same pace. And this standstill in productivity growth is a new phenomenon for the United Kingdom, which has enjoyed a productivity growth rate of just over 2% since the mid-1990s. Had productivity continued to grow at this rate since the crisis, GVA per hour worked would be 20% above current levels. Economists refer to the gap between current levels of productivity and trend productivity growth as the ‘productivity puzzle’.

Whilst it is not unusual for productivity to fall during a crisis, the stark absence of any recovery has left economists and policy makers baffled. What has made this particularly interesting is that it has taken place whilst GDP, employment and total hours worked have each increased. Whilst good for unemployment, it means that standards of living have fallen. This reiterates the importance of directing attention towards productivity.

The causes of low productivity growth since the recession are unclear, though several causes have been suggested. These include a decline in financial services productivity, weak investment following the crisis, high employment rates, and growth of employment in less productive sectors such as hospitality and health. Much of the UK’s pre-crisis productivity growth was driven by manufacturing and financial services. This made the economy particularly susceptible to decline in these sectors.

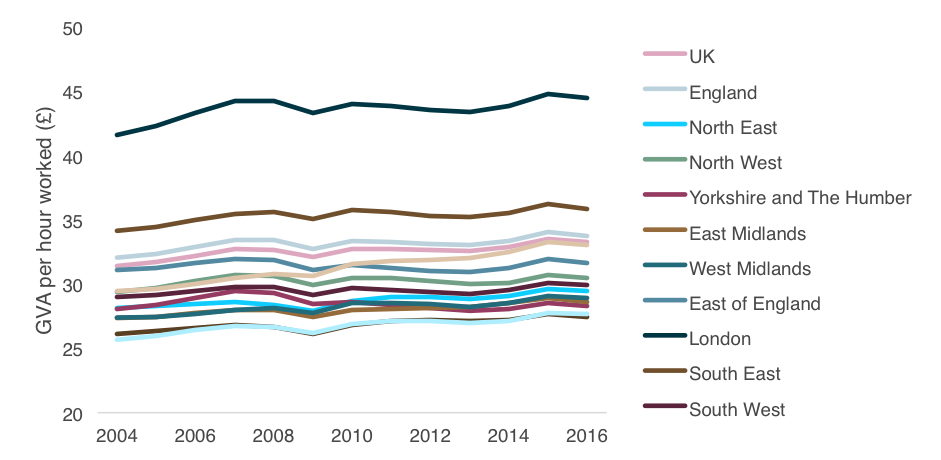

The trend at a national level is clear, but it is equally important to recognise that productivity in the UK varies dramatically between regions.

London has the UK’s highest GVA per hour, which at £44.48 is 62% greater than average GVA per hour in Wales of £27.43. Only London and the South East have higher levels of GVA per hour than the national average. Productivity growth has been stagnant across all regions. Productivity in the UK increased by a mere 0.3% between 2011 and 2016. Even the fastest-growing part of the UK, Scotland, only managed an increase in productivity of 0.8%.

Overall, low productivity growth in the UK threatens the nation’s future standard of living. Using the LIS process to support improvements in productivity is vital for local residents, particularly among the young and less educated who will be worst affected in an environment of stagnant real wage growth and high house prices in many parts of the country.

Raising productivity

We have outlined what productivity is, why it’s important, Britain’s position and some of the underlying factors behind weak levels of productivity growth since the Great Recession of 2008.

It is easy when talking about productivity to lose sight of the fact that productivity growth happens through real tangible investments and changes in individual businesses and places.

In this segment, we present a simple model of what productivity looks like from a business perspective. Crucially, raising business productivity is not exclusively the preserve of technology investment or larger companies. Smaller companies can achieve significant increases in their productivity through better processes, and through improving how they sell their products.

Improving business efficiency requires addressing one or more of these three aspects. We go through each of these in turn:

Inputs

Businesses can increase productivity through lowering the cost of inputs, such as the costs of utilities (water, gas, electricity), raw materials (chemicals, furniture, inventory), transportation, staff, and capital (bank overdrafts, mortgages, loans). Many of the steps that businesses might take to reduce input costs fall firmly within the purview of businesses and are hard for local authorities to influence. These are things such as switching suppliers or negotiating better prices with existing suppliers, re-organising staff schedules to maximise efficiency and hedging capital or foreign exchange risk for businesses that trade overseas.

Nonetheless, there are things that local authorities and LEPs can do to influence certain input factors, particularly transport and the availability of skills through better training provision. Provision of utilities, the right kinds of commercial space and the right kinds of housing for the workforce can be influenced through the planning system. At a more basic level, ensuring that there is adequate provision of parking spaces or electric vehicle charging points, for example, can facilitate the activities of businesses.

Business support also has a role to play in helping companies re-examine input costs. This is particularly true of smaller companies that may have less management capacity than larger firms. The role of the growth hub in helping address this will be important.

Case Study – Energy efficiency measures

The UK has some of the highest commercial energy prices in Europe. This continues to place pressure on many UK businesses, especially in energy intensive sectors such as manufacturing. Whilst the rising cost of electricity has the greatest effect on energy intensive businesses, the threat of higher power prices is something that all businesses face. In order to insulate themselves against the cost of higher electricity prices, many businesses have invested in microgeneration and energy efficiency measures.

Many UK businesses have installed solar panels on their buildings or in their grounds. This includes a wide range of businesses including retailers, manufacturers, warehousing companies and agricultural firms. Ownership of the building is usually an important precondition. This investment produces operational savings which are expected to recover the capital costs of the installation, typically within five years or so.

Processes

In our simple model, it is at the transformation phase that businesses add value to their inputs and therefore produce their outputs. The range of potential improvements that can be made to processes is extremely broad and depends on the nature of the sector and the nature of the company in question.

As an example, services companies often focus on human capital improvements such as staff training as well as investments which aid their staff in functioning more effectively. For instance, the introduction of scheduling software or partial automation.

Case Study – Data analysis for improved targeting – Carphone Warehouse

Carphone Warehouse wanted to increase customer conversion rates. To achieve this objective, trial stores utilised software and data analytics to better understand customer behaviour. The data provided store managers with a much deeper understanding of customers, allowing them to see what types of customers are more likely to make a purchase, the times of day that most purchases are made, and the display arrangements that attract the most footfall. By continuously monitoring the impact of changes through an iterative process, individual Carphone Warehouse stores were able to allocate staff more effectively, leading to higher conversion rates.

On the other hand, manufacturing companies invest more heavily in capital improvements including new machinery, automation of standardised processes and the use of more efficient techniques, often linked to technological breakthroughs, which reduce inputs and waste.

Case Study – Investment in tech to cut costs – JJ Churchill

Leicestershire based precision engineering firm JJ Churchill illustrates the impact new technology can have on productivity in a manufacturing company. JJ Churchill, which specialises in manufacturing components for the aerospace, defence, diesel engines, nuclear and power generation sectors, faced significant bottlenecks in the production of certain fixtures, leading to longer lead times. With the emergence of additive manufacturing, JJ Churchill collaborated with 3D printing specialist HK3D to develop a new technique for fixture manufacturing. By combining traditional and additive manufacturing, JJ Churchill not only saved time and money but obtained valuable knowledge and a new method of conceptualising product design. This made the firm more competitive in a global market.

For local authorities and local partners, there is a role to play in helping firms finance process improvements where these require investment. In many cases, this will involve signposting firms to specialist financing options and / or public funds. For smaller firms, there is a role for local authorities and their partners in helping spread best practice, supporting technology demonstrators and hands-on business support. Not all the support required is about technology or requires significant investment. Managerial capacity in smaller firms can be limited, and poor processes can become embedded over time. Providing perspective on how processes could be improved can therefore make an important difference.

Outputs

As well as improving the efficiency of processes, businesses can increase their overall productivity by improving their ability to sell their products or services. This might involve improving their ability to charge higher prices for the same services (due to uniqueness or brand cache) or expanding their market so that economies of scale are achieved. Therefore, achieving productivity gains at the output phase typically involves improving sales and marketing, but also reflects improved business strategy, product positioning and design.

In many cases, productivity can be best achieved through product differentiation and the establishment of a valuable brand image.

Case Study –Cooperating to maintain standards – The Harris Tweed Authority

The Harris Tweed Authority exemplifies a case where increasing the value of your output requires mastery of marketing rather than technology. In an age of mass cloth manufacture and low-cost clothing, it is difficult to imagine a small group of about 250 crofters handweaving woollen cloth in Scotland’s remote Outer Hebrides remaining a commercially viable proposition. By banding together, producers of Harris Tweed have protected their tweed from cheap imitations and promoted a cloth associated with quality, tradition, longevity, sustainability and style. This has allowed weavers to maintain a premium price tag and export their tweed to over 50 countries from traditional markets in Europe, North America and Australasia to emerging markets in Brazil, China, India and Russia. Premium brand strategies can be observed across nearly all markets, but crucially they are available to SMEs as well as large firms.

Some firms also have the potential to increase sales volumes, such as by exporting their good or service beyond their local market.

Case Study – Reaching new markets with the Internet – Hatton’s Model Railways

Liverpool based, Hatton’s Model Railways which transformed itself from a small high street retailer into one of the largest model railway shops in the world with 25,000 product lines and an annual turnover of approximately £15m. For Hatton’s, online retailing allowed them to sell directly to customers nationally and internationally. By utilising inventory software and moving to a more efficient warehouse, rather than primarily retail premises, Hatton’s has been able to increase productivity substantially. By expanding sales volume and competing on price, Hatton’s demonstrates how a retailer can increase outputs to offset fixed costs whilst simultaneously using volume as a catalyst for investment in more efficient processes.

Local authorities and their partners can support these kinds of market-based productivity improvements through the provision of export support, and through business support which helps firms improve their sales channels or market themselves more effectively. In some cases where there are longstanding geographic clusters, local authorities and their partners might also have a role in promoting place-based specialisms or brands.

Case Study - Modular housing – Precision Homes Cornwall

Our simple model of productivity in businesses has looked at productivity enhancement in three sections: inputs, processes and outputs. In practice, businesses combine elements of all these aspects. This is reflected in the case of Precision Homes, a builder of modular houses based in Cornwall. Housing supply and a lack of skilled builders have been touted as a major issue in the United Kingdom. As an alternative to traditional construction methods, modular housing has become an increasingly viable and attractive alternative.

By utilising steel rather than timber frames, Precision Homes benefit from a lighter structure which reduces material, faster fabrication times and the ability to recycle offcuts. Manufacturing the company’s homes in an offsite 20,000 square foot manufacturing environment allows productivity to be greatly enhanced over traditional construction. Manufacturing can take place all year round, irrespective of weather conditions whilst the use of standardised parts and heavy machinery makes construction more efficient and reduces wastage. This allows the company to achieve a scale which spreads its fixed costs.

Productivity in places

Whilst productivity increases happen in individual businesses, the environment in which firms operate has an important impact on how productive they can be. In this section, we touch on some of the place-based factors that drive productivity growth and we discuss the different ways in which places can conceptualise productivity increases in their areas.

There are a variety of factors that influence the productivity of businesses in specific places:

- Good governance through strong and transparent institutions, and through providing policy certainty and stability which helps reduce investment risk.

- The provision and quality of infrastructure, such as roads, rail, ports, airports and broadband/communications, and the provision and reliability of public transport links which connect the labour force to employment areas.

- The quality and availability of appropriate business premises.

- Links between firms and local research institutions, and collaboration on development. The provision of support to early stage commercialisation efforts in fields where the translation time from the underpinning science to a marketable product requires long-term patient capital.

- Factors which help attract and retain skilled workers into an area. This can be quite broad ranging, from the right provision of affordable housing (affordable in the broadest sense), the presence of good schools in an area, quality of green space and leisure and cultural assets, and the extent of University provision which attracts talented young people to the area to study. Quality of life is also a key factor in attracting inward investment.

- Factors which help existing residents gain and improve relevant work-related skills, including good quality schools and colleges, and post-16 and post-18 offers that reflect the needs of local businesses.

Productivity also reflects the location of businesses and sectors. Productivity tends to be higher where economic activity is higher, for instance in industrial clusters or denser urban areas. Such clusters reflect the intrinsic benefits of companies locating in close proximity to similar companies. These include reduced logistics costs, larger and more specialised labour pools, and knowledge spillovers.

Local authorities and their partners have some control over these factors through their planning and investment activities and can play a vital role in setting the ambition and vision for an area. They can also encourage the formation of local business groups that can help address some of these issues. Business Improvement Districts (BIDs) can play an important role in helping places function better.

Thinking about productivity raising interventions in places

These factors suggest an important role for local authorities and their partners. When crafting a strategy to raise productivity, and deciding on the interventions needed to achieve that strategy, there are at least three important variables to think about.

Firstly, the extent to which specific interventions are short term or long term. Clearly, in all cases, the aim is to deliver long-term improvements but some interventions are more immediate than others. For example, a targeted business support programme could provide support within a matter of months or a year, whereas a programme of housebuilding, or an early-years education improvement programme will have much longer timescales before positive effects are seen.

This doesn’t mean that short term interventions should be prioritised as it may be that longer-term interventions will have the most impact, but it is an important dimension to consider.

Secondly, there is usually a trade-off between interventions which affect ‘whole economy’ productivity (such as a new roads), and more targeted support for key businesses and sectors. What makes sense locally will partly depend on the nature of your local economy and where the opportunities for growth are.

Thirdly, it is important to think about how local people will benefit from investments. Investments in certain high value sectors may raise productivity but may have limited benefits for local people. An increasing amount of public debate is focussing on the importance of Inclusive Growth – that is, growth which has benefits people on lower incomes, as well as simply improving aggregate levels of output.

The answer to which mix of interventions is best will depend on the nature of your place and what you and your partners want to achieve. It will also depend on the level and type of resources you have available. It is essential to ground these choices in a strong evidence base.

References

The Bank of England’s explanation of the UK Productivity Puzzle, and an analysis of the challenge for the UK.

The Office for Budget Responsibility’s resources on productivity.

In the next section, we explain how to develop an evidence base on local productivity.

Should you have any questions about the content of this section, please get in touch via [email protected].

2. Building the productivity evidence base for Local Industrial Strategies

In this section, we provide step-by-step instructions on how to develop and present a LIS productivity evidence base using publicly available data sources.

This section consists of three videos which cover:

- What we need to measure - the reasons for undertaking a productivity analysis and an introduction to the main variables we need to measure.

- Key outputs - an overview of the two key outputs - GVA and employment - which are crucial to a strong productivity analysis, and how to produce them.

- Supplementary outputs - an overview of four further outputs which can help build the local picture of productivity in your economy.

Any resources referenced are linked to beneath the respective videos.

Part 1 - What we need to measure

Resources:

- Cheshire and Warrington LEP Consolidated Industrial Strategy Evidence Base, February 2019

- West Midlands Local Industrial Strategy, May 2019

- Greater Manchester Local Industrial Strategy, June 2019

Part 2 - Key outputs

Resources:

- Nomis Official Labour Market Statistics

- ONS Regional Gross Value Added (balanced) by Local Enterprise Partnership in England

- Regional Gross Value Added (balanced) by combined authority, city regions and other economic and enterprise regions of the UK

- Regional gross value added (balanced) local authorities by NUTS1 region

- Gross Value Added at basic prices: Implied deflator

Part 3 - supplementary outputs

Resources:

Should you have any questions about the content of this section, please get in touch via [email protected].

3. Engaging your business base

Using data to analyse your economy is important. But it is important to recognise that the range of available data is limited and usually published with a lag of one or two years. To understand what is really going on in businesses and sectors, to understand their challenges and opportunities, it is vital to speak with firms directly.

This section focuses on three key elements of business engagement and outlines the practical considerations for delivering them effectively:

- Understanding your business base

- Methods for business engagement

- Maintaining a strong relationship with local businesses

It is supplemented by the key principles for business and stakeholder engagement outlined in Module 2 along with good practice case studies.

Understanding your business base

To engage with business effectively, you need to know what firms exist in your area. There are several options for establishing this:

- Using the business rates register

- Purchasing the Inter Departmental Business Register - or IDBR - data for your area

- Purchasing a commercial dataset of companies

- Drawing on other published datasets of firms

- Consulting with local business groups and people with insight

These are not mutually exclusive. In fact, using more than one source will be important to make sure you don’t just engage with the largest businesses, or those smaller businesses whose owners / managers are best connected locally.

The first step towards understanding your business base is to utilise existing internal council data sources.

The business rates register is a good source of information. The relative amounts of business rates will give an indication of which businesses are important to engage with. Your council might also have other lists of companies from other previous work.

As a council, you are also able to purchase data from the Inter Departmental Business Register - or IDBR - for your area. This is an ONS dataset that underpins the Business Register and Employment Survey (or BRES) dataset which we discussed in the last section. This data is confidential and there is a range of guidelines on how the data must be accessed and handled. Nonetheless, at £150 per year of data, this offers good value for money and provides information on employment levels and SIC codes of businesses as well as names and addresses. Analysing the data across multiple years allows you to assess which companies are growing fastest in your area.

There are also a number of commercial datasets available which provide information on businesses. The benefit of these is that some of them offer specialist data which the ONS doesn’t collect, and their front-end may make it easier to analyse and select the data you are most interested in. Unlike the IDBR you will be able to publish some of the key data. However, they are typically much more expensive than the IDBR, so this needs to be borne in mind.

There are a number of open-source datasets available which list businesses in specific sectors. These are typically produced nationally, but some of them may help you identify local firms.

Finally, it is important to draw on the knowledge of local business experts both inside and outside the council. This can include council officers who deal with businesses, Local Chambers and FSB branches, Business Improvement Districts in your area, and the LEP Growth Hub and sector groups.

Using these sources you will be able to piece together a list of businesses that you should be engaging with. As important as engaging with the ‘big names’ in your area is engaging with smaller firms in important sectors. This is why using a business database to identify fast-growing firms is as important as drawing on existing knowledge of local businesses.

Methods for business engagement

Engagement with business can take place online or in-person through targeted engagement, meetings with groups of businesses or existing local networks.

There are a range of methods for engaging with businesses, including:

- Surveys or a call for evidence

- Using an online platform – such as Citizen Space

- One-to-one meetings

- Running workshops on relevant topics

- Talking to the FSB, CBI, and Chamber of Commerce and using existing local networks

Of the options for online engagement, a call for evidence is more useful when you are dealing with a wide array of potential respondents and where you are less sure of the key issues. A survey is more useful than a call for evidence either when: you are directing your questions to a more precise set of businesses (e.g. small tech companies); when you have a more specific set of questions to ask; and / or when the answers to those questions are themselves more specific.

A call for evidence is the most open method of gathering information from businesses. This can be sent out to businesses via email with a single email address where responses can be sent. You should communicate why you are undertaking the research – i.e. to support the Local Industrial Strategy – what you will use the information they provide for, and why it is important that they respond. You should set out a small number of high-level questions that you are interested in and a request for any data or other evidence which demonstrates the points they are making.

A business survey is similar but with more directive questions. Similarly to a call for evidence, you will need to explain why you are undertaking the research and how you will use the answers. You can use software such as SurveyMonkey to set up an online survey that will collate the responses for you. Depending on how directive you want to be, you can use a mixture of open and closed questions. It is important to ensure that the survey is well-written and designed so that it can be completed relatively quickly. The survey and the email communicating it should be clear about roughly how long the survey will take to complete.

The remaining forms of engagement involve meeting with businesses directly, either on a one-to-one basis or through group meetings and workshops.

One-to-one meetings work better when either a business finds it challenging to have the time to get along to meetings, or where you want to - or they want to - be able to speak candidly about issues. One-to-one meetings are usually best managed using a semi-structured interview approach. In other words, you have a set of questions that you want to ask, but you give sufficient space for the interviewee to talk about the things that they think are most important.

Meetings or workshops with multiple businesses can be an effective way of meeting with many businesses at once and can help you understand and work through differences in opinion between different businesses. For example, if one business says that it is difficult to attract skilled young people, but another similar business does not have this problem, you can use the opportunity in a meeting to try and understand the reasons for this difference.

There are lots of techniques for getting the most out of group meetings and workshops. In brief, it is important to:

- Have a clear agenda which is understood in advance and to ask questions in advance, so you are not reliant on the spontaneous thoughts of participants.

- Set the scene well, using evidence you have already gathered to set out some concise messages.

- Ask the right questions and organise the discussion in a way which allows all attendees to participate effectively.

- Try and sequence the discussion so you start with an agreement of the main issues, before considering what might be done to address those issues.

Finally, you can utilise the regional offices of key business organisations to support your engagement efforts and potentially utilise existing networks. Links to key resources are outlined below.

- A list of the CBI’s regional offices

- A list of the Federation of Small Business’s regional offices

- A list of regional Chambers of Commerce

- Business Improvement Districts (BIDs) and information on how to set them up

Maintaining a strong relationship with local businesses

Whilst the immediate purpose of engagement might be to develop your evidence base more fully, you should be mindful of the longer term value of the engagement and not lose sight of this.

Over the longer term it is important to maintain and grow relationships with businesses. The principles for engagement explored further in Module 2 are also good principles for maintaining an ongoing relationship with businesses. The principle of not over-engaging may dictate that engagement in your area is best handled by – for example – the LEP or the Chamber. Nonetheless, it is important that you maintain good links with whoever is leading on this locally, that you attend events and are kept up-to-date with what businesses are saying. Where there are no existing strong networks or groups, you should consider how the local authority could support the setup of these where there is sufficient interest from businesses.

Where the local authority is leading on these relationships it is important to consider how you communicate with businesses and facilitate opportunities for networking that strengthen your own relationships with business, and those of local businesses with each other. It is important that what businesses say to you is communicated across the Council to relevant services so that improvements can be made to these services where necessary. It is important that where specific problems are identified that are within the Council’s power to address these are acted upon.

Should you have any questions about the content of this section, please get in touch via [email protected].

4. Evidence in communication and delivery

Having developed an evidence base, it is important to use it to identify: the opportunities and challenges facing your area as well as the initiatives that will address these opportunities and challenges, ensuring they are underpinned by reasonable evidence of their practicality and ability to make a difference.

In this section, we talk about how to do this, how best to develop additional evidence that will inform the development of sensible interventions, and how to use project design to enhance the evidence available locally.

The first step is to understand the main opportunities and challenges facing your area. At this point, you should have an evidence base that consists of both statistical data and observations from businesses and other stakeholders. Both of these should indicate a mix of opportunities and challenges.

Building a narrative

At the simplest level, therefore, you need to list out the findings and feedback, and look for common themes where there is consensus across the data and what stakeholders are saying. You might use a simple framework to do this such as a SWOT analysis. Or you might group these thematically according to the five foundations of productivity in the Government’s Industrial Strategy. It may be that in your area there is another way of grouping these issues which helps illuminate the commonalities between them. There is no single right way to do this, and you might want to do this in more than one way to try different ways of conceptualising the same set of issues.

Going through this process will probably establish that some issues are clearly evidenced by the data and the engagement with businesses and stakeholders, and some issues are less clear. This could happen for example in cases where the qualitative feedback from stakeholders is not matched by data (or where there just isn’t data available on that particular issue), or where feedback from stakeholders gives a mixed message on a particular issue.

Where the evidence is less clear, you should consider how important the issue is and, where it is particularly important, whether there is more research you can do in a time and cost-effective way that would highlight the answers (where possible drawing on existing sources of information). If you are able to do this, this will help tighten up the emerging list of opportunities and challenges.

Having done this, it is important to produce a concise narrative that tells the ‘story’ of your place and explains what the opportunities and challenges are. This doesn’t need to be very long, but it does need to be clear and to be clearly based on the evidence. By drawing on the different information available to you this could be a mix of graphs, maps, quotes, and case studies that convey a clear set of points and act as a call to action for what problems and possibilities should be addressed through the Local Industrial Strategy. By presenting this in a clear way, you will be able to facilitate a conversation with stakeholders and decision-makers about what is best to do.

For further information on developing a place narrative, including case studies, see Module 3.

Developing and accessing evidence about what works

Having identified the key opportunities and challenges for your area, you will need to think about what it is you want to do or what you want to work with partners, including the LEP or Combined Authority, to address.

In deciding which investments and interventions you want to make, there will be a number of considerations. For example, you will need to think about what investments other actors – such as Government, businesses, and higher education institutions - are already making. You will want to consider the amount and type of budgets available to you, your capacity (and the capacity of partners) to deliver projects, and the trade-offs between different types of intervention and investment.

The aim of this section is not to discuss the decision-making process itself, but to explain how to ensure that the interventions and investments you select are based on evidence. Just as it is important to use evidence to underpin your assessment of the opportunities and challenges, it is also important to draw on an understanding of what other similar places have done to address similar issues, and how well this has worked.

Gathering evidence on this partly depends on the nature of the intervention that is being proposed. Many interventions will build on your existing experience or previous work. For these kinds of interventions, the best evidence will be previous project reports, evaluations, and the experiences of local project delivery leads and beneficiaries. It is important to learn from the findings of previous projects to ensure better outcomes in the future.

In other cases, interventions will be of a standard type where there is lots of experience nationally even if the initiative in question is new to your area. In these cases, drawing on the findings of national studies or case studies will be helpful. Where there are acknowledged leaders / success stories nationally, you should consider making contact with the delivery leads in these places to learn from them the key lessons from their experience. It may be that existing professional networks might help you to do this.

However, some interventions will be significantly different from typical economic development interventions. This might be because the interventions in question use new ideas, or because they address issues which have a local sectoral or place specificity. In developing initiatives for the Local Industrial Strategy process, this is likely to be common, as your sectors and businesses will have specific needs that you will want to address.

In these cases, it will be important to use desk research and relevant professional networks to identify whether similar projects have been undertaken before.

Available evidence sources

There are a large number of potential sources of evidence for projects or case studies. Some of the key sources of information include:

- The strategies, business plans and project evaluations published by other local authorities and LEPs.

- Publications and press releases from local government organisations including: the Core Cities group, the County Councils Network, the Key Cities group, the District Councils Network, the LEP Network, and the Local Government Association.

- Government agencies such as Innovate UK, and the National Infrastructure Commission.

- Research by think tanks such as the OECD, NESTA, the Centre for Cities, the Brookings Institute, the Joseph Rowntree Foundation, the Centre for Progressive Policy and many others.

When looking at case studies of other projects, it’s important to ask the following questions:

- What are the basic metrics of the project? How much did it cost? Over what time period was it active? What outputs did it achieve?

- Who delivered the project? How was the project delivered?

- How successful has the project been? Is this success evidenced, for example with a formal, independent evaluation? If not, how credible is the evidence presented?

- What were the key success factors? Can these be replicated locally? For example, the success factors might include the quality of the delivery team, the strength of existing networks, the presence of a university anchor institution, etc.

- Are there any important contextual differences between your place and the case study? If these differences are likely to make the initiative less effective, how could this be mitigated? For example, if a project case study was based on an urban geography, but you are considering implementing this in a rural geography, what needs to change to ensure the same or better outcomes? Equally, some of these projects might be in an international context, in which case it will be important to think about the different economic, cultural, and policy context which has impacted the success of these projects.

Using monitoring and evaluation to build and enhance local evidence – and make better decisions

Crafting and monitoring interventions

Projects offer a good opportunity to build evidence about your economy, businesses, and what works locally. Through designing in project monitoring, evaluation and reporting it is possible to capture a range of measures that can help improve the evidence base for decision-making.

There is a range of technical guidance available about how to put good monitoring and evaluation processes in place. The Treasury Magenta Book is the official Government guidance on best practice in project evaluation. The What Works Centre provides evaluation guidance and case studies on their website, as well as more hands-on support on this subject to local authorities and LEPs. In addition to this, each LEP should have a Monitoring and Evaluation Framework in place, and your authority may likewise have existing policies and arrangements for evaluating projects.

You should draw on these sources of guidance to think through the logic of your intervention and how best to ensure an unbiased and accurate evaluation of the impact of your projects.

On a project-by-project basis, and a programme basis, you should consider what variables can be measured, and what macro-level indicators might be affected. You should set project and programme level objectives that reflect the evidence you have on similar interventions and on local evidence on need.

Project and programme measures should be SMART measures, that is: Specific, Measurable, Achievable, Relevant, Time-bound. Specific means that you should be clear about the specific measurements you wish to use, and (where relevant) the sources of data. Measurable means that a variable should be capable of measurement either as collected in standard statistics, or through the project itself. Achievable means that the measures should be realistic in relation to the baseline and what has been achieved by similar projects in other contexts. Relevant means that they relate to the opportunities and challenges you have deemed to be most important locally. Time-bound means that there are clear timescales in which the project outputs should be measured.

Where the measures you are using fall outside standard statistics, you will need to establish how you will measure these at the outset, over the life of the project, and at the end – in order to understand how the project has performed.

As an example, you might want to measure how a particular business support programme affects employment levels in firms that benefit from the programme. Here you might capture that information using a series of project monitoring reports that capture employment levels in the firm at the outset of the project and then at specific milestones in the project including the end of the project. By looking at how employment levels have changed you will have one measure of project success. Clearly, there may be other measures which are equally important, so understanding these and evaluating the project on a broader basis will be important.

This kind of measurement requires you to have project monitoring and reporting in place to capture outputs at key points. It will be important to ensure that you have the capacity in place to ensure that this monitoring is undertaken on a timely and accurate basis. Where project beneficiaries are self-reporting data, you need to consider whether this creates any challenges in terms of accuracy – either because they might simply not know the data you are looking for, or because they might be incentivised to provide erroneous figures. You also need to ensure that the measures you choose are unambiguous, so that beneficiaries know what you are asking them to measure.

If you are proposing to look at area-level statistics – for example, overall employment in an area or employment within a particular sector – you need to consider whether this is a good measure given the scale of the intervention. In other words, will the effect of the intervention be obscured by the influence of other factors on that same measure?

Quantified metrics often tell a partial story about why change has happened. Understanding the perspectives of participants and beneficiaries of interventions is important in order to provide a richer picture of the impact of a project. For example, the metrics on a business support project may over- or under-state the impact of the intervention, if there were other big impacts on business performance over the same period – such as a key customer changing account. Therefore, alongside collecting data on key metrics it is important to use semi-structured interviews of key project actors or beneficiaries.

Reporting this data effectively, and feeding it back into decision-making processes, is key to ensuring better decisions over the long-term. It is hard to do this effectively over large numbers of projects, so it is important that summary data is presented in a clear and concise way that allows decision-makers to understand what has worked, what hasn’t worked, and where interventions could be altered to be more effective.

Monitoring and evaluating projects effectively, and reporting the outcomes in a way that enhances decision-making, can be challenging and requires good management over a period of time to be effective. It’s important to maximise the impact of this activity by, for example, using the engagement with beneficiary businesses as a way of building broader evidence about the challenges and opportunities in certain sectors.

References and useful resources

The What Works Centre’s guidance on “How to Evaluate”. They also run regular sessions on implementing this in practice – you can find a list of their upcoming events here.

The Department for Business, Energy and Industrial Strategy (BEIS) has a useful report on evaluating local economic growth policies.

The Joseph Rowntree Foundation’s report on how the LIS can deliver inclusive growth through its interventions.

The HMT Green Book – guidance from central government on appraisal and evaluation.

The HMT Magenta Book – practical guidance on the specific needs of analysts and policy makers working in public policy.

Congratulations, you have reached the end of this module. You should now be well-prepared to go on to develop the evidence base to analyse productivity in your area.

Should you have any questions about the content of this section, please get in touch via [email protected].