Our Budget 2021 On-the-Day briefing summarises the key announcements for councils and provides an initial LGA view

Download

Introduction

The Budget, delivered on Wednesday 3 March, provided a formal update on the state of the economy, responded to the new economic and fiscal forecast from the Office for Budget Responsibility and announced the Government’s fiscal measures. The full set of documents is available on the HM Treasury website.

The LGA submitted a representation ahead of the Government’s March 2021 Budget. We have published a media statement responding to today’s announcements:

Key messages

- The Budget has set out plans to provide support for jobs and businesses as we emerge from the pandemic. Councils know their local areas best and have delivered for their communities. They must be trusted to lead efforts to rebuild and level up our economy, get people back into work and create new hope for their residents.

- It is good that councils have been placed at the heart of the delivery of new funds such as the Levelling Up Fund and Community Renewal Fund and we look forward to working with the Government on the detail. However, we are concerned by the prospect of competitive bidding as we want all our resources and energy to be used to support regeneration in our communities.

- Emergency government grants distributed by councils have been a vital lifeline to struggling businesses worried about their future. It is positive that that further funding will be provided to support businesses and councils remain ready to use their local knowledge and expertise to distribute this money quickly.

- We welcome the extension of the furlough scheme which has been vital in securing jobs that otherwise may have been lost. Going forward, it will be crucial to ensure people seeking to re-enter the labour market get the local support, advice and training they need to face the future. Councils stand ready to work in partnership with the Government at the earliest stage to shape new and re-design existing Plan for Jobs initiatives, so they are effective and connected on the ground to ensure no community is left behind.

- Many households could be economically vulnerable for some time, so we are pleased that the Chancellor has announced an extension to the Universal Credit uplift. This must be kept in place for as long as it is needed so that households are not pushed into financial hardship as a result of vital support being withdrawn. The mainstream benefits system will need to provide the first line of support to those in need with councils given adequate local welfare funding to provide additional help.

- It is very disappointing that the Budget did not announce councils’ public health grant for the next financial year, which is only just over three weeks away. The lack of new funding for public health runs contrary to the aim of addressing the stark health inequalities exposed by COVID-19 and levelling up our communities. The grant must be published with the utmost urgency.

- We were also disappointed to see no mention of adult social care or children’s services. The Government must urgently bring forward its proposals for adult social care, including a clear timetable for reform, so that we can finally put social care on a sustainable footing. We also continue to emphasise the need for additional funding for child and family support services. As a starting point, returning the Early Intervention Grant to 2010/11 funding levels by providing an extra £1.7 billion would enable councils to reinstate some lost preventative and early help services.

- The Budget included some welcome investment to reduce carbon emissions, but councils want to see further progress if we are to unlock the significant opportunities renewable energy infrastructure can provide, particularly in the green growth sector and in job creation. Councils are keen to work with the Government to harness the opportunities the green economy provides.

- Councils continue to lead local efforts to protect lives and livelihoods from COVID-19 but still face substantial cost pressures and income losses. The Government has provided a significant financial package of support so far to help but the ongoing financial impact and unpredictability of the pandemic means this support must be kept under review. Our recent estimates suggest that up to a further £2.6 billion will be needed to cover the cost pressures and non-tax income losses of 2020/21 in full. We continue to call on the Government to meet – in full - all cost pressures and income losses incurred by councils as a result of the pandemic.

- Public finances are undoubtedly under huge strain but investment in our local services will be vital for our national economic and social recovery. Alongside providing a multi-year settlement in 2022/23 to put councils on a long-term sustainable footing, bringing power and resources closer to people is the key to improving lives, tackling deep set inequalities and building inclusive growth across the country.

Public finances and business rates

See below:

Public expenditure and the Spending Review

The Chancellor announced that:

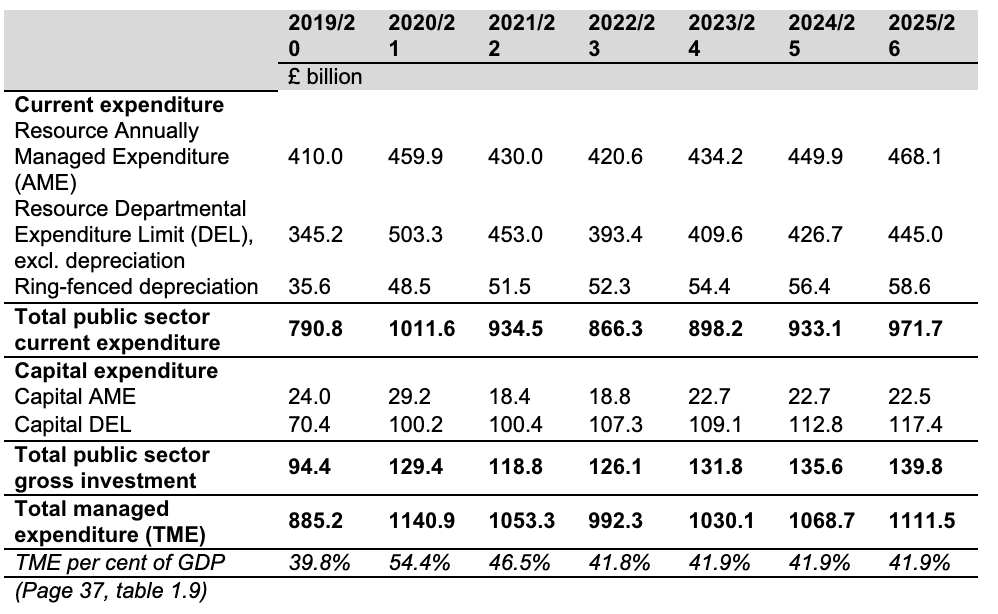

- From 2021/22 to 2025/26, the Resource Departmental Expenditure Limit (RDEL) spending will decrease from £453.0 billion to £445.0 billion. Total Managed Expenditure (TME) will increase from £1,053.3 billion to £1,111.5 billion within the same time frame. (Page 37, table 1. 9, Appendix A in this document)

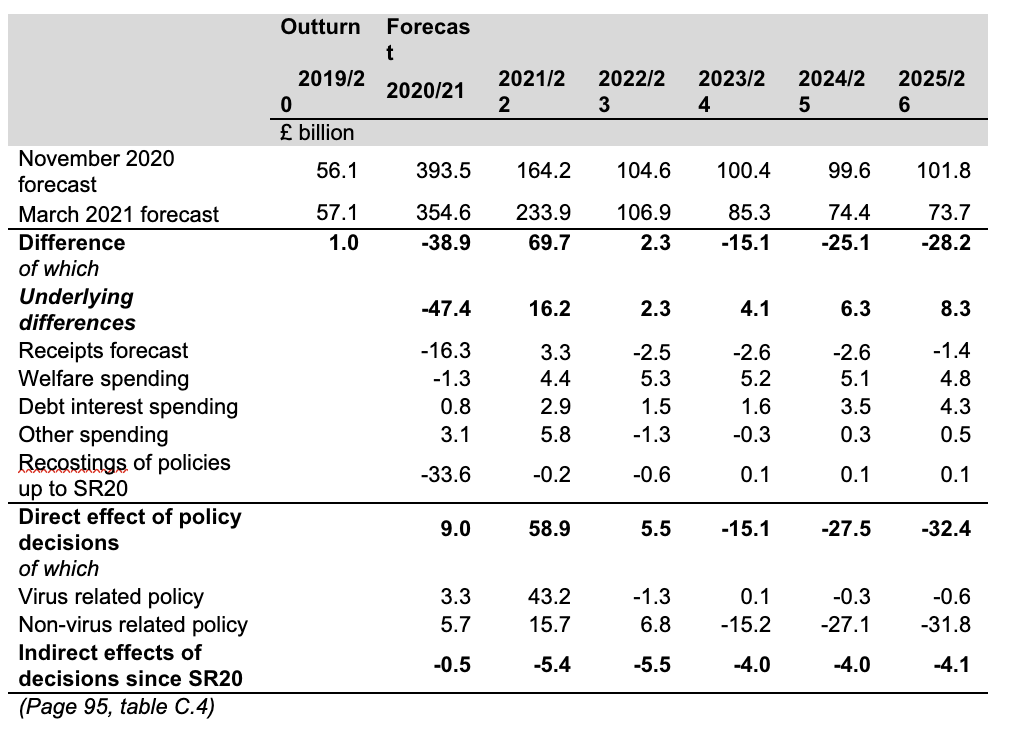

- Public sector net borrowing is forecast to decrease from £233.9 billion in 2021/22 to £73.7 billion in 2025/26. (Page 95, table C.4, Appendix A in this document)

- The Government will conduct a Spending Review later this year to set future departmental RDEL and CDEL (Capital Departmental Expenditure Limit) budgets as well as devolved administrations’ block grants. Details on the Spending Review, including the RDEL and CDEL envelopes, will be set out in due course. (Page 35, paragraph 1.69)

LGA view

- Public finances are undoubtedly under huge strain but investment in our local services will be vital for national economic and social recovery. Alongside sustainable long-term investment for councils in the upcoming Spending Review, bringing power and resources closer to people is the key to improving lives, tackling inequalities and building inclusive growth across the country as we move forward.

- As we set out in our Budget submission the Government must, as soon as possible in 2021, deliver a multi-year Spending Review covering the rest of this Parliament which allows councils to support their communities to rebuild and recover from the pandemic.

Business Rates

The Chancellor announced that:

- The Government will continue to provide eligible retail, hospitality, and leisure properties in England with 100 per cent business rates relief from 1 April 2021 to 30 June 2021. This will be followed by 66 per cent business rates relief for the period from 1 July 2021 to 31 March 2022, capped at £2 million per business for properties that were required to be closed on 5 January 2021, or £105,000 per business for other eligible properties. Nurseries will also qualify for relief in the same way as other eligible properties. (Page 49, paragraph 2.47)

- Local authorities will be fully compensated for the loss of income as a result of these business rates measures and receive new burdens funding for administrative and IT costs. (Page 49, paragraph 2.48)

- Full Business Rates relief will apply in Freeport tax sites in England, once designated. Relief will be available to all new businesses, and certain existing businesses where they expand, until 30 September 2026. Relief will apply for five years from the point at which each beneficiary first receives relief. (Page 58, paragraph 2.115)

- The Government will invest a further £180 million in 2021/22 in additional resources and new technology for HMRC. Among other measures this will enable it to carry out initial design and development of Digitalising Business Rates to help modernise the business rates system in England and support more effective analysis and oversight of the collection of the tax. (Page 55, paragraph 2.104)

LGA view

- The LGA welcomes the business rates relief measures announced in the Chancellor’s Budget as they will provide continuing relief to businesses which have been hard hit by the COVID-19 pandemic. We welcome the Government’s continuing commitment to pay section 31 grant to councils so that they are fully compensated for the loss in rates and additional burdens.

- It will be important for guidance to be issued as soon as possible so that councils can liaise with their software providers to enable ratepayers to be billed correctly.

- Not all businesses affected by the COVID-19 pandemic are covered by the continuing rates relief and they may struggle to pay business rates. Councils are also affected by appeals for material changes of circumstances due to the effects of COVID-19 which have not yet been resolved. We repeat our call for the Government to extend its Tax Income Guarantee to cover all income losses in both 2020/21 and 2021/22.

- We look forward to working with HMRC on the continued digitalisation of the business rates system. The Government should make it clear that this will not change the responsibility of billing authorities for collecting the tax.

COVID-19

See below:

COVID-19 Contain Outbreak Management Framework

The Chancellor announced that:

- In March, the Government will publish an updated COVID-19 contain outbreak management framework for local areas, which will set out how national and local partners will continue to work with the public at a local level to prevent, contain and manage outbreaks. This will include details of the enhanced toolkit of measures to address Variants of Concern. (Page 85, paragraph A.64)

LGA view

- Councils want to work with the Government to ensure the updated COVID-19 contain outbreak management framework is refreshed in partnership with local government officers and councillors to ensure local expertise is captured, lessons are learnt, and those accountable to their local residents are able to shape the framework.

- A local approach to managing outbreaks of COVID-19 will be fundamental to opening the economy and regaining our freedoms. As we progress along the Roadmap, it will be important to reflect to ensure funding meets local demand, especially for enforcement, Surge Testing and tackling areas of enduring transmission.

Domestic vaccine deployment funding

The Chancellor announced that:

- The Government is allocating £1.65 billion for 2021/22 to continue the vaccine deployment programme in England. (Page 47, paragraph 2.34)

LGA view

- Additional funding to help the UK reach its target of offering a first dose to every adult by 31 July is welcome news and we look forward to seeing full details at the earliest opportunity. This major boost is designed to continue the quick and efficient initiative, which has so far been hailed as a huge success.

- Councils have been playing a key role in supporting the frontline care sector and offering advice to people worried about the vaccine's safety or efficacy as well as practical support such as closing roads and managing queues. It is vital that councils continue to receive enough funding to support their role in the national vaccine rollout programme.

Restart Grants

The Chancellor announced that:

- The Government will provide ‘Restart Grants’ in England of up to £6,000 per premises for non-essential retail businesses and up to £18,000 per premises for hospitality, accommodation, leisure, personal care and gym businesses, giving them the cash certainty, they need to plan ahead and safely relaunch trading over the coming months. The Government is also providing all local authorities in England with an additional £425 million of discretionary business grant funding, on top of the £1.6 billion already allocated. Altogether, this support will cost £5 billion. This brings the total cost of cash grants provided by the Government to £25 billion. (Page 48, paragraph 2.43)

LGA view

- We welcome the announcement of further grants to businesses which have had to close or are affected by the COVID-19 pandemic and the additional discretionary business grant funding. We are seeking clarification over the time period for this grant and will press the Department for Business, Energy and Industrial Strategy (BEIS) to publish guidance as soon as possible to ensure a speedy delivery of the grants to businesses.

Welfare

The Chancellor announced:

- The Government is extending the temporary £20 per week increase to the Universal Credit standard allowance for a further six months in Great Britain, on top of the planned uprating. This measure will apply to all new and existing Universal Credit claimants. (Page 45, paragraph 2.19)

- Government is making a one-off payment of £500 to eligible Working Tax Credit claimants across the UK, to provide continued extra support over the next six months. (Page 45, paragraph 2.20)

- The Government will maintain the higher surplus earnings threshold of £2,500 for Universal Credit claimants for a further year until April 2022, when the threshold will revert to £300. (Page 46, paragraph 2.21)

- The Government will continue the suspension of the Minimum Income Floor (MIF) for self-employed Universal Credit claimants until the end of July 2021. The MIF will be gradually reintroduced from August, but DWP work coaches will be given discretion to not apply it on an individual basis where they assess that claimants’ earnings continue to be affected by COVID-19 restrictions. (Page 46, paragraph 2.22)

- The Government will support claimants to keep more of their Universal Credit awards while ensuring they meet their financial obligations by bringing forward previously announced changes. From April 2021, the period over which Universal Credit advances will be recovered will increase to 24 months, while the maximum rate at which deductions can be made from a Universal Credit award will reduce from 30 per cent to 25 per cent of the standard allowance. These measures were previously due to be implemented from October 2021. (Page 46, paragraph 2.23)

- The Government will continue to treat Working Tax Credit claimants across the UK who have been furloughed, or experienced a temporary reduction in their working hours as a result of COVID-19, as working their normal hours for the duration of the CJRS. This allows these claimants to remain eligible for Working Tax Credit. (Page 46, paragraph 2.24)

LGA view:

- The LGA is pleased that the Government has committed to maintaining the £20 per week uplift to Universal Credit and has retained measures including the suspension of the Minimum Income Floor, which will help to protect households during economic recovery

- However, there are some concerns that a one-off payment, rather than a sustained monthly uplift, may make it harder for households to budget effectively. It is therefore vital that Government communicates clearly and effectively with claimants and works effectively with councils to support financial inclusion and resilience.

- It is the LGA’s view that the national benefits system should provide the principal safety net for low-income households. The uplift and protections must be maintained for as long as it is needed, to provide vital support throughout economic recovery and ensure that councils can target local discretionary support to those who need it most.

- We are pleased that the Government has brought forward positive measures on deductions and advances. It is crucial that these are integrated with local preventative work and crisis support that councils and partners provide to households at risk of debt and financial hardship. This will help to ensure that households are supported back to financial stability and resilience. We continue to call for local welfare funding to be restored to at least £250 million per annum to enable councils to deliver an efficient and sustainable local safety net.

No-interest loans scheme pilot

The Chancellor announced that:

- The Government will provide up to £3.8 million of funding to deliver a pilot no-interest loans scheme. The scheme will help vulnerable consumers who would benefit from affordable short-term credit to meet unexpected costs as an alternative to relying on high-cost credit. (Page 48, paragraph 2.40)

LGA view

- The LGA welcomes measures to ensure that low-income households are not pushed into using high cost credit.

- We have been working with a range of councils who are already working with credit unions and others in their local places, to provide viable alternatives to high-cost credit, through our work on ‘reshaping financial support’. We look forward to hearing more detail about the scheme, and to working with Government to ensure it integrates effectively with financial inclusion support that councils are already providing to residents.

Furlough

The Chancellor announced that:

- The government is extending the Coronavirus Job Retention Scheme until September 2021 and setting out the next steps for the Self-Employed Income Support Scheme. These will continue to provide vital support for people across all parts of the UK. (Page 66, paragraph 3.11)

LGA View

- The furlough extension to the end of September is welcome.

- We must also plan for longer-term to help those currently on furlough and who may need different jobs in the future. Councils want to work with Government to plan for these issues.

Workforce, jobs and skills

See below:

Plan for jobs

The Chancellor announced that:

- Alongside this direct support for business, the government’s Plan for Jobs, reinforced by Spending Review 2020 (SR20), launched action to support employment, including through the Kickstart and Restart schemes and doubling the number of Department of Work and Pensions work coaches. (Page 44, paragraph 2.8)

LGA View

- COVID-19 has resulted in hundreds of thousands of people needing to find new jobs and reskill. The additional Plan for Jobs announcements are welcome and necessary to help communities recover and rebuild.

- The challenges of economic recovery will be different in each place across the country. Consequently, local government stands ready to work in partnership with national government to shape new or re-design existing Plan for Jobs initiatives such as Kickstart, Restart and the Lifetime Skills Guarantee. We can help ensure these programmes meet the needs of different places and help join up disconnected national schemes at the front-line of delivery, so they are more effective.

- The LGA welcomed investment to support up to 250,000 green jobs as part of its Ten Point Plan. To deliver the substantial change needed in the UK economy by 2050, local government will play a key role in facilitating technology transitions in homes and businesses, informing constituents, supporting local businesses and the upskilling of the local workforce.

- The LGA has published research which considers the projected net zero jobs and the associated skills demands across England by 2030 and 2050. In 2018 there were 185,000 full-time workers in England’s low-carbon and renewable energy economy. In 2030 across England there could be as many as 694,000 direct jobs employed in the low-carbon and renewable energy economy, rising to over 1.18 million by 2050.

Apprenticeships

The Chancellor announced that:

- The Government will extend and increase the payments made to employers in England who hire new apprentices. Employers who hire a new apprentice between 1 April 2021 and 30 September 2021 will receive £3,000 per new hire, compared with £1,500 per new apprentice hire (or £2,000 for those aged 24 and under) under the previous scheme. This is in addition to the existing £1,000 payment the government provides for all new 16-18-year-old apprentices and those aged under 25 with an Education, Health and Care Plan, where that applies. (Page 47, paragraph 2.30)

- The Government will introduce a £7 million fund from July 2021 to help employers in England set up and expand portable apprenticeships. […] Employers will be invited to bring forward proposals here, and in particular the Creative Industries Council will be asked to do so in recognition of the potential benefits of this new approach for the creative sector. (Page 47, paragraph 2.31)

LGA View

- The additional six-month extension to incentives (to September 2021) and the increase payments will be very helpful. As national COVID-19 restrictions will remain in place until at least June, an extension of the new apprenticeship incentives to March 2022 could help employers can take full advantage once national restrictions are lifted.

- The flexi-apprenticeship announcement is welcome and could have a wider application beyond the proposed target sectors. Local government, with the right resources, could help coordinate apprentices moving between employers.

- There are wider reforms that we would like to discuss with Government to make the levy more effective:

- empower local areas to align apprenticeship activity to local skills strategies to widen participation to disadvantaged groups and specific cohorts;

- empower employers to collaborate more easily to transfer and pool funds;

- allow a proportion to subsidise apprentices’ wages and administration costs;

- extend the two-year expiry date for Levy funds; and

- work with local government to co-design unspent Levy and non-Levy funding plans in local areas now with a view to progressive Work Local proposals.

Traineeships

The Chancellor announced that:

- The government will provide an additional £126 million in England for high quality work placements and training for 16-24-year-olds in the 2021/22 academic year. Employers who provide trainees with work experience will continue to be funded at a rate of £1,000 per trainee (Page 47, paragraph 2.29)

LGA View

- As young people have been disproportionately impacted by the crisis, additional traineeships will provide the much needed first step to further learning and work. Every young person, including those most disadvantaged or furthest from the labour market, will want to make the most of a traineeship. Some may have personal or financial challenges and will often need local support services. These services will need to be funded and councils who hold statutory duties to support young people into education and training could help provide the support.

Economy and infrastructure

See below:

New Towns Deals

The Chancellor announced that:

- The Government is confirming over £1 billion from the Towns Fund for a further 45 Town Deals across England. This will help to level up regional towns, giving them the tools to design and implement a growth strategy for their area and aiding local recovery from the impacts of COVID-19. (Page 60, paragraph 2.121)

LGA view

- Councils understand the strengths and challenges of their towns and city centres best. The pandemic has accelerated existing trends in how our high streets are used throughout the country. This additional funding will help many places to adapt their town centres and ensure they remain vibrant hubs for businesses and socially.

UK Infrastructure bank

The Chancellor announced that:

- The new UK Infrastructure Bank will provide financing support to private sector and local authority infrastructure projects across the UK, to help meet government objectives on climate change and regional economic growth. The Bank will:

- be able to deploy £12 billion of equity and debt capital and be able to issue up to £10 billion of guarantees

- offer a range of financing tools including debt, hybrid products, equity and guarantees to support private infrastructure projects

- from the summer, offer loans to local authorities at a rate of gilts + 60 basis points for strategic infrastructure projects

- establish an advisory function to help with the development and delivery of projects (page 57/58, paragraph 2.112)

LGA view

- The rate to be offered to local authorities is 0.4 per cent below the standard Public Works Loans Board (PWLB) rate and is the same as the previous local infrastructure rate. Further details of how the scheme will work are being sought, but local authorities will welcome the opportunity to borrow at cheaper rates to invest in infrastructure.

Culture, Tourism and Sport

The Chancellor announced that:

- The government will provide £300 million to extend the Culture Recovery Fund to continue to support key national and local cultural organisations in England as the sector recovers. (Page 50, paragraph 2.56)

- Sport Recovery Package – The government will provide £300 million for continued support to major spectator sports in England, supporting clubs and governing bodies. (Page 50, paragraph 2.59)

- £28 million to support the Queen’s Platinum Jubilee event in 2022, delivering a major celebration for the UK (Page 69, paragraph 3.22)

- £2.8 million to enable a UK & Ireland bid for the 2030 FIFA Men’s World Cup, as well as an investment of £25 million in UK grassroots community sports facilities, supporting the future of grassroots football (Page 69, paragraph 3.22)

- The Government will provide £1.2 million to mitigate the financial effects of COVID-19 on the UEFA Women’s Euro football competition and deliver a successful tournament in England in 2022, supporting the sport to grow and thrive. (Page 50, paragraph 2.60)

LGA view

- Culture and sport play a central role in our national status on a world stage. The upcoming Festival of Britain and national sports events like the World Cup and UEFA Euro football competition are also vital in promoting community sport and inspiring people to take up physical activity. Councils are working hard to promote physical activity in the aftermath of COVID-19 and this bid will support their efforts.

- Leisure centres have been hard hit by the pandemic, and the additional investment in grassroots sport plus the £18,000 grants will provide some support. However, further investment of at least £700 million through the National Leisure Recovery Fund is needed to effectively stabilise the sector and ensure key assets like swimming pools remain available to communities. Sport England research prior to the pandemic indicated that much of this infrastructure is already ageing and in need of urgent replacement which could cost approximately £1.5 billion.

- The arts and culture sector has an important role to play in our road to national economic recovery, in supporting vibrant local places in which people can live and work, promoting footfall on our high streets and helping the renewal of tourism and the visitor economy. This package, and the extension of VAT and Business rates relief for hospitality businesses, acknowledges the value of these sectors and their contribution to society, our economy, and our standing in the world.

National Infrastructure Commission (NIC) Towns and Regeneration Study

The Chancellor announced that:

- The Government will commission a new NIC study on towns and regeneration, which will consider how to maximise the benefits of infrastructure policy and investment for towns in England. Any recommendations in reserved areas will be relevant to the whole of the UK. (Page 61, paragraph 2.126)

- The Government also published the Terms of Reference for the study.

LGA view

- Ensuring that infrastructure policy and investment works for all our places is vital if the whole of the country is able to participate in economic growth and support jobs. This is important study and local government is ready to support with robust local evidence to ensure that the study reflects the needs of different places.

Housing – Modern Methods of Construction

The Chancellor announced that:

- The Ministry of Housing, Communities and Local Government (MHCLG) will establish a Modern Methods of Construction (MMC) Taskforce, backed by £10 million of seed funding, to accelerate the delivery of MMC homes in the UK. The Taskforce will consist of world-leading experts from across government and industry to fast-track the adoption of modern methods of construction. It will be headquartered in MHCLG’s new office in Wolverhampton. The Taskforce will work closely with local authorities and Mayoral Combined Authorities, including the West Midlands Combined Authority and the Liverpool City Region who have already brought forwards ambitious proposals. (Page 60, paragraph 2.125)

LGA view

- Resolving the housing crisis needs long-term local leadership in order to meet the diversity of needs in local markets. Although there is not one single solution, Modern Methods of Construction (MMC) can play an important role, and we welcome the announcement of the Taskforce and the associated seed funding. It will be crucial that the development of MMC works within the locally led planning system.

- Councils also need powers to invest in new homes for those that need them. This includes urgent reform to the Right to Buy scheme, to enable councils to keep all sales receipts, and set discounts locally, as well as having at least 5 years to spend receipts. Additional government support to build the capacity and skills in local government to enable them to build more homes would also support the long-term future of MMC.

Flooding

The Chancellor announced that:

- The £5.2 billion flood and coastal defence programme for England announced at Budget 2020 will start in April this year, with schemes in Waltham Abbey, Sunderland, Preston, Warrington, Salisbury, Rotherham and Doncaster expected to start construction in 2021-22. These schemes will better protect over 3,700 homes from flooding. (Page 62, paragraph 2.134)

LGA view

- The LGA welcomes the flood and coastal defence programme starting in April with seven locations in England including Doncaster, which has previously been significantly impacted by flooding. Councils are well placed to lead a local approach to flood defence. Funding for flood defences needs to be devolved to local areas and sit within a new national framework for addressing the climate emergency.

Low carbon energy

The Chancellor announced that:

- In line with the commitment to double spending on energy innovation, the Government is announcing support for the development of new solutions to cut carbon emissions and accelerate near-to-market low-carbon energy innovations:

- the launch of a £20 million programme to support the development of floating offshore wind technology across the UK;

- the launch of a new £68 million UK-wide competition to implement several first-of-a-kind energy storage prototypes or technology demonstrators;

- a £4 million UK-wide competition for the first phase of a biomass feedstocks programme, to support the rural economy in making improvements to the production of green energy crops and forestry products. (Page 64, paragraph 2.150)

LGA view

- The LGA has been calling for investment in renewable energy and we welcome the announcement that funding has been allocated from the government’s £1 billion Net Zero Innovation Portfolio fund. Councils are well placed to test transformational solutions and want to play a key role in developing a flexible, resilient energy supply that realises the full economic benefits and supports the creation of local green skills and jobs.

- Renewable energy infrastructure can provide significant opportunities in the green growth sector and job creation. A partnership between local and national government can make this happen.

- We will work with Government to understand how councils can access the low carbon energy innovation funding and competitions to support place-based low carbon solutions.

- The Budget has not set out any new investment in housing retrofit or infrastructure to reduce the environmental impact of waste and recycling services. Both areas have an important role to play in reducing carbon emissions and will also support local jobs. We will continue to make the case for long term investment in these key areas.

Devolution and levelling up

See below:

The Levelling Up Fund

The Chancellor announced that:

- The Government is launching the prospectus for the £4.8 billion Levelling Up Fund alongside Budget. The Levelling Up Fund will invest in infrastructure that improves everyday life across the UK, including town centre and high street regeneration, local transport projects, and cultural and heritage assets. The prospectus will provide guidance to local areas on the process for submitting bids, the types of projects eligible for funding, and how bids will be assessed. To ensure that funding reaches the places most in need, the government has identified priority places based on an index of local need to receive capacity funding to help them co-ordinate their applications. (Page 59, paragraph 2.119)

LGA view

- The leading role for councils identified in the Levelling Up Fund Prospectus is evidence that the Government has listened to our calls for a greater focus on the challenges and opportunities of place It is good that councils have been placed at the heart of the delivery. We look forward to working with government on the detail but are very concerned by the prospect of competitive bidding processes at a time when councils want to be fully focused on protecting communities and businesses from the impact of the pandemic.

- COVID-19 has highlighted some of the entrenched inequalities that exist across the country. We note that this prospectus only sets out the approach to the first round of bids. In order to tackle the scale of the challenge ahead Government will need to build on this commitment in future years.

- The Government has committed to providing capacity funding to help those councils most in need of levelling up to develop high quality bids for the Fund. This is an important step in helping mitigate the risks of local capacity issues as the result of COVID-19 restricting local areas from pulling together bids for the benefit of their communities.

- We recognise the importance of collaborating with businesses, civic institutions, communities, and MPs across place to bring together high quality and impactful bids. However, it is vital that the criteria setting out how many bids areas can submit to Government is simple and promotes collaboration, rather than competition between neighbouring councils. It is welcome that the prospectus recognises the primary role of local government and confirms that all bids should have the approval of the relevant authority responsible for delivering them

Freeports

The Chancellor announced that:

- East Midlands Airport, Felixstowe & Harwich, Humber, Liverpool City Region, Plymouth and South Devon, Solent, Teesside and Thames have been successful in the Freeports bidding process for England. Subject to agreeing their governance arrangements and successfully completing their business cases, these Freeports will begin operations from late 2021. The Freeports will contain areas where businesses will benefit from more generous tax reliefs, customs benefits and wider government support, bringing investment, trade and jobs to regenerate regions across the country that need it most. (Page 58, paragraph 2.113)

LGA view

- We congratulate the eight chosen areas and their local government partners on their successful bids.

- It will be vital that Freeports create new jobs and opportunities for local people and Government must remain alive to the risk of economic displacement of UK domestic businesses as it progresses with winning areas.

- There were over thirty bids for Freeport status from across the country evidencing a high-level interest from local areas. The Government should therefore continue to consider how it can best work with the unsuccessful areas as part of its wider ambition to ‘level up’ the country and ensure no area is left behind.

Build Back Better: our plan for growth

The Chancellor announced:

- A ‘Build Back Better: our plan for growth’ publication setting out the government’s plans to support economic growth through significant investment in infrastructure, skills and innovation.

- This identifies three key priorities: level up the whole of the UK; support the transition to Net Zero; and, support [the Government’s] vision for Global Britain.

- It also identifies a wide range of long-term strategies, including: an export strategy; the devolution and local recovery white paper; the transport decarbonisation plan; the net zero strategy; the national bus strategy; and, the full conclusion of the post-18 review of education and funding.

LGA view:

- While we recognise that today’s budget was focused on responding to the unprecedented economic shock of the coronavirus pandemic, many of the persistent structural challenges facing the country will require sustained effort over the long term.

- Councils will be crucial partners in achieving these goals and we are committed to working with Government to build a thriving, connected and sustainable future for communities across the country.

- In particular, we look forward to the publication of the Devolution and Local Recovery White Paper. This should include a clear statement of purpose and principles for the government’s devolution policy as well as a transparent timeframe for delivering changes.

Public health

The Chancellor did not make any new announcements related to public health.

LGA view

- Local public health teams have played an absolutely crucial role in tackling the pandemic so far. It is extremely disappointing that the Budget did not announce councils’ public health grant for the next financial year, which is only just over three weeks away. Funding for public health services have been reduced by £700 million in real terms over the past five years. The public health grant must be published with the utmost urgency. The lack of new funding for public health runs contrary to the aim of addressing the stark health inequalities exposed by COVID-19 and levelling up our communities. It is also out of step from increases in funding for the NHS. Keeping people healthy and well throughout their lives reduces pressure on the NHS and social care.

Mental health funding

The Chancellor announced:

- An additional £3 billion for next year to support the NHS recovery in England from the impacts of COVID-19. This includes: around £1 billion to begin tackling the elective backlog – enough funding to enable hospitals to cut long waits for care by carrying out up to one million extra checks, scans and additional operations or other procedures; and funding to help to address waiting times for mental health services, give more people the mental health support they need, invest in the NHS workforce. (Page 84, paragraph A.55)

LGA view

- The pandemic is having a significant impact on the emotional wellbeing and mental health of families, individuals and particularly our children and young people. Continued investment for NHS mental health services is welcome and an opportunity to give greater recognition to the role of local government supporting the Long Term Plan’s mental health goals for people with severe and enduring mental health needs.

- Key to tackling the COVID-19 pandemic has also been supporting people’s mental wellbeing. Maintaining the funding focus solely on treating mental ill-health means a missed opportunity to develop locally-led approaches to helping people stay mentally well as we emerge from the pandemic. Councils’ statutory children’s and adults’ mental health services and wider public health responsibilities need parity of funding with NHS mental health services, so that councils – harnessing all of their relevant services and assets, and working closely with partners – can help the whole population to be mentally healthy, prevent the escalation to clinical services and work with health colleagues to support people of all ages who are mentally unwell.

- It is important to recognise that a significant proportion of the mental health workforce, in particular professionals working in early intervention and community support, are employed in local government. It is crucial that the whole of the mental health workforce is properly supported alongside much needed additional investment, whether employed by local government, by private and voluntary providers and the NHS.

Armed Forces

The Chancellor announced that:

- The Government will provide up to £475,000 to Armed Forces charities in 2021/22 to support the development of a digital and data strategy for the sector. (Page 48, paragraph 2.37)

- The Government will provide an additional £10 million in 2021/22 to the Armed Forces Covenant Fund Trust, to deliver charitable projects and initiatives across the UK that support veterans with mental health needs, ensuring that veterans can access the services and support that they deserve. (Page 48, paragraph 2.38)

LGA view

- All councils have signed the voluntary Armed Forces Covenant and are working in partnership with Armed Forces charities and others to honour their obligations to those who have served our country. Funding to support the development of a digital and data strategy will further help to reach and meet the needs of the Armed Forces community, and should build upon what local partnerships have already achieved.

- Additional funding for mental health support for veterans is good news for our Armed Forces community and will help them access timely, effective and integrated mental health support. Councils are ready to work with armed forces charities, health and other local partners to further strengthen mental health support for veterans and ensure it links to wider mental health activity.

- Whilst Armed Forces Covenant Fund Trust grants provide a welcome boost to local Covenant projects, its short-term and limited nature means that it cannot fully fund the local capacity needed to sustainably drive forward the Armed Forces Covenant given the other funding pressures local government faces. It is vital that councils continue to receive enough funding to support veterans and their families across a range of services which also affect mental health, including housing, money advice, employment support and other public health and wellbeing services.

Other

See below:

Community Ownership Fund

The Chancellor announced that:

- The Government will create a new £150 million Community Ownership Fund to help ensure that communities across the UK can continue to benefit from the local facilities and amenities that are most important to them. From the summer, community groups will be able to bid for up to £250,000 matched funding to help them to buy local assets to run as community-owned businesses. In exceptional cases up to £1 million of matched funding will be available to help establish a community-owned sports club or buy a sports ground at risk of loss from the community. This will help ensure that important parts of the social fabric – like pubs, sports clubs, theatres and post office buildings – can continue to play a central role in towns and villages across the UK. (Page 60, paragraph 2.124)

- The £150 million Community Ownership Fund, helping to ensure that communities across the UK can continue to benefit from the local facilities and amenities that are most important to them. (Page 68, paragraph 3.21)

LGA view

- The LGA welcomes this new funding and agrees with the principle of empowering communities to take responsibility for their community assets where they might otherwise no longer be available for community use. This is particularly important given the economic impact of the pandemic on smaller businesses.

- Significant challenges still exist around community ownership of local assets including ongoing sustainability, resilience, and skills. Many sports facilities are also in need of repair and unsuitable for transfer without refurbishment, which an expanded National Leisure Recovery Fund could support. We look forward to hearing more from Government about how this funding will be distributed.

Homelessness

The Chancellor announced that:

- From June 2021, care leavers up to the age of 25 and those under the age of 25 who have spent at least three months in a homeless hostel will be exempt from the SAR in Universal Credit and Housing Benefit, helping more vulnerable people access suitable housing. These measures were previously due to be implemented from October 2023. These measures apply in Great Britain, and the Northern Ireland Executive will be funded to similarly bring forward implementation of these measures. (Page 46, paragraph 2.28)

LGA view

- We have previously called for and welcomed the Government’s commitment to extend exemptions to the Shared Accommodation Rate. We are pleased that the introduction of these exemptions will be brought forward. This will reduce the likelihood that unaffordable housing pushes vulnerable young people and victims of domestic abuse and human trafficking into unsuitable accommodation or homelessness.

Domestic abuse

The Chancellor announced that:

- The Government will provide an additional £19 million towards tackling domestic abuse, including £15 million in 2021-22 across England and Wales to increase funding for perpetrator programmes that work with offenders to reduce the risk of abuse continuing, and £4 million between 2021-22 and 2022-23 to trial a network of ‘Respite Rooms’ across England to provide specialist support for homeless women facing severe disadvantage. This comes on top of the £125 million announced at SR20 for local authorities to deliver the Domestic Abuse Bill’s new statutory duty to support victims. (Page 48, paragraph 2.39)

LGA view

- We are pleased the Government has responded to LGA’s calls to invest in perpetrator interventions and tackling domestic abuse, by announcing an additional £15 million for perpetrator programmes and £4 million for ‘Respite Rooms’.

- The LGA has asked the Government to publish a National Domestic Abuse Perpetrator Strategy. This is a welcome emphasis on the importance of addressing perpetrator’s abusive behaviour and preventing domestic abuse from occurring in the first place.

- We look forward to hearing further information about when the funding will be made available and who will be eligible to receive it. We hope that councils, working in partnership with the sector, will have an opportunity to bid for this funding.

Overseas electors

The Chancellor announced that:

- The government is providing an additional £2.5 million to remove the limit preventing British citizens who live overseas from voting after 15 years. (Page 48, paragraph 2.41)

LGA view

- The LGA welcomes the announcement that Government will provide funding to implement this policy. The additional costs of this policy change will fall on local authorities as it will involve additional work by electoral registration officers and the full costs will need to be met by government on an on-going basis.

- We look forward to hearing more from Government about how this funding will be distributed to councils and a commitment to ongoing funding being made available for this additional burden.

APPENDIX A. Public expenditure, revenue and deficit forecasts

Total managed expenditure

Changes to public sector net borrowing since November 2020

Social care and health

See below: